Discover the best online brokers to reinvest dividends with commission-free trading.

Reinvesting dividends could mean compound growth for your portfolio. But reinvesting them manually can be a hassle. This is why you could benefit from a dividend reinvestment plan (DRIP).

DRIP brokers handle the whole process for you, so you can just sit back and watch your portfolio grow. Interactive Brokers is our top pick thanks to its mix of powerful trading tools and global market access.

Below, you can find out which other DRIP investing brokers made the grade, how to set up a DRIP, the top strategies, and more.

Best Brokers for Dividend Investing in 2024 – My Top Picks

| Rank | Broker | Score | Visit |

|---|---|---|---|

| 1 | Interactive Brokers | 9.1/10 | Visit |

| 2 | Charles Schwab | 8.0/10 | Visit |

| 3 | Fidelity | 6.5/10 | Visit |

| 4 | Robinhood | 6.0/10 | Visit |

| 5 | JP Morgan | 0.0/10 | Visit |

| 6 | Vanguard | 6.0/10 | Visit |

| 7 | E*Trade | 6.5/10 | Visit |

DRIP Investing Brokers Compared

The best DRIP brokers at a glance

- Best overall: Interactive Brokers

- Best for experienced investors: Charles Schwab

- Best for mutual funds: Fidelity

- Best for beginners: Robinhood

- Best for retirement planning: JP Morgan Chase

- Best for large portfolios: Vanguard

- Best for hands-off investors: E*Trade

Interactive Brokers

| Minimum deposit | $0 |

| Stocks commission | $0 for IBKR Lite clients, up to $0.005 for IBKR Pro |

| Fractional shares? | Yes |

| DRIP fees | $0.005 commission |

| Demo account? | Free trial |

A combination of global stock market access, impressively low fees, and advanced trading and research tools make Interactive Brokers the go-to platform for traders and investors.

It’s easy to enroll in IBKR’s automatic stock dividend reinvestment. Just head to Dividend Election in your account settings and choose whether you want to receive cash or reinvest. US and Canadian shares are eligible for the DRIP.

The Interactive Brokers DRIP may not be perfect—you can only enroll at the account level, so you can’t pick specific stocks for reinvestment. Another thing to be aware of is that you’ll be charged a commission on stocks purchased through the DRIP.

This is even true for IBKR Lite clients, who don’t usually pay commissions on stocks and ETFs. However, with commissions of just $0.005 and no account fees, Interactive Brokers is still one of the most affordable trading platforms.

The DRIP can actually be combined with IBKR’s Stock Yield Enhancement Program. This means you can earn extra income by lending the shares in your DRIP plan.

Beyond the DRIP, standout features include comprehensive reporting, market commentary podcasts, and IBKR GlobalAnalyst for finding undervalued stocks worldwide.

- All US and Canadian shares eligible for DRIP, plus access to 150 other markets

- Earn extra income by lending your shares

- A ton of educational material is available

- Try out IBKR with a free trial

- You can’t enroll individual stocks in the DRIP

- Dividend reinvestment is subject to a commission charge

Charles Schwab

| Minimum deposit | $0 |

| Stocks commission | $0 (Broker-assisted trades cost $25) |

| Fractional shares? | Yes |

| DRIP fees | $0 |

| Demo account? | No (but access to the paperMoney simulator after making a real account) |

Schwab brings decades of experience to the table, combining the traditional with the modern. If you like classic first-rate customer service, you can call up your broker and have them place orders on your behalf, for a fee.

But Schwab’s acquisition of TD Ameritrade means you’ll also have access to the state-of-the-art thinkorswim® platforms. This means deep customization, 400+ technical analysis tools, and a trading simulator for test-driving strategies.

Automating dividend reinvestment is as simple as heading to your Positions page and choosing Yes in the Reinvest column. The best part is that all of your cash dividends can be reinvested with fractional shares, so your investment can compound all the faster.

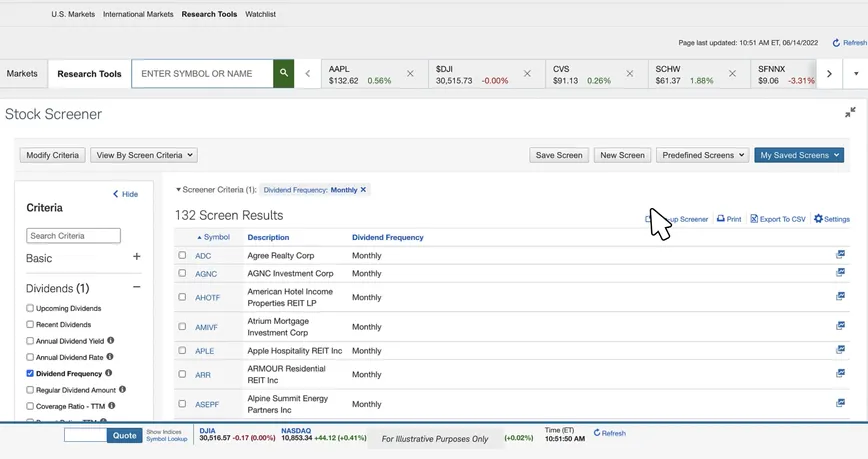

Wondering which stocks are best for a DRIP? Schwab’s screener will help you with that. Filter stocks by dividend yield, frequency, growth rate, and more. Look at charts for stocks that interest you and compare them side by side.

If your DRIP is for your retirement, Schwab offers a variety of IRAs. These come with retirement resources, calculators, insights, and no additional fees.

Talking of fees, Schwab’s pricing is another benefit. The broker charges a 0% commission on stocks or ETFs, and there’s no fee for dividend reinvestment. With no platform, inactivity, or account opening fees, you can easily avoid paying a dime.

The one downside is that Schwab isn’t the most straightforward platform to navigate for new users. If you’re not familiar with technical charts, screeners, and detailed trade tickets, you might have a bit of a learning curve with Schwab. Thankfully, there are plenty of how-to videos, trading guides, market commentary, and support is just a phone call away.

- Holistic customer service with a satisfaction guarantee

- Schwab doesn’t charge fees for fractional DRIP investing

- Stock screeners with multiple dividend filters

- State-of-the-art trading tools

- There’s a $25 if you want to place orders over the phone

- The Schwab platform isn’t very intuitive for new investors

Fidelity Investment

| Minimum deposit | $0 |

| Stocks commission | $0 |

| Fractional shares? | Yes |

| DRIP fees | $0 |

| Demo account? | No |

Fidelity is the go-to platform for mutual funds. It offers more than 10,000 of them, along with tools, analysis, and insights from its expert fund managers. The best part? Fidelity’s mutual funds are eligible for a DRIP.

If you head to the Dividends and Capital Gains page in your account, you can choose whether to reinvest in the same assets with fractional shares or pool your dividends to buy other stocks and funds.

The research tools are handy for finding your ideal investments. Easily find mutual funds for income generation or screen stocks according to dividend yield. On top of that, you’ll get access to Morningstar data and the latest news.

If you want to reinvest dividends to build your retirement savings, Fidelity is also a great place to do just that. You’ll get a free personalized retirement plan, timely insights, and a choice of tax-advantaged accounts.

Fidelity stands out for its support and advice. You can go old-school with a dedicated advisor and phone access. Meanwhile, modernists will appreciate digital advice and robo-investing. Alternatively, go down the DIY route if you want full control over your portfolio.

The fees are more than affordable. Benefit from no platform fee and a 0% commission on stocks and ETFs.

So are there any downsides? Well, Fidelity isn’t the most intuitive platform for newbies. In fact, it’s not that dissimilar to Schwab, but the difference is that Fidelity’s trading tools aren’t quite as advanced.

- Choice of dedicated support, robo-investing, and more

- You can pool dividends and invest them in different assets

- World-class support and expert advice

- Access to market research, news and Morningstar data

- The platform isn’t super intuitive for newbies

- Some planning and advice services have significant eligibility requirements

Robinhood

| Minimum deposit | $0 |

| Stocks commission | $0 |

| Fractional shares? | Yes |

| DRIP fees | $0 |

| Demo account? | No |

New to DRIPs or investing in general? Then Robinhood is a good place to start. The app is designed to be easy to use, whatever your experience. There are big, clear buttons that make navigation obvious. Plus you can learn investing basics in the Learn section.

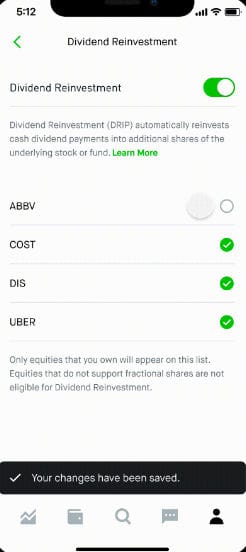

Simply enable dividend reinvestment in the Investing section of your account. This will show you a list of the eligible stocks you hold. Toggle on the ones for which you want to enable a DRIP.

You can reinvest the full dividend amount as Robinhood offers fractional shares. In fact, it’s a great app for those with a modest portfolio. There’s a minimum investment of just $1, plus no commissions on stocks.

Robinhood has branched into retirement services with its IRA account. You’ll get a 1% match on contributions, or a 3% match if you subscribe to Robinhood Gold. Robinhoods other offerings include crypto, options, and a debit card.

Now for the negatives. By catering to beginner investors, Robinhood compromises on advanced trading functionality. You’ll still get access to customizable charts, but with significantly fewer technical indicators and order types than the other brokers on this list.

You should also be aware of the limited asset offering. You won’t find many asset types such as mutual funds, bonds, and futures. Plus, Robinhood’s 5,000 securities are a drop in the ocean compared to Schwab’s 14,000+. But then Robinhood’s spot crypto features are something you won’t find on Schwab.

- Very easy to use for new investors

- Invest all your dividends with fractional shares

- Get a 1-3% match on IRA contributions

- Access to spot crypto trading

- A more limited asset offering than competitors

- Lack of advanced trading tools

JP Morgan

| Minimum deposit | $0 |

| Stocks commission | $0 |

| Fractional shares? | Yes (for DRIP only) |

| DRIP fees | $0 (unless charged by mutual funds themselves) |

| Demo account? | No |

Looking for somewhere to reinvest dividends for your retirement? Chase has got you covered. It has plenty of retirement guides and calculators. The JP Morgan Wealth Plan is a great way to plan your goals, track progress, and simulate different scenarios.

Use the Chase Mobile app to schedule a meeting with a JP Morgan Advisor if you want expert input. You can choose a traditional IRA, a Roth IRA, or a General Investment Account. But the best bit is that when transfer or rollover to one of these JP Morgan Self-Directed Investing accounts you could get up to $700 free.

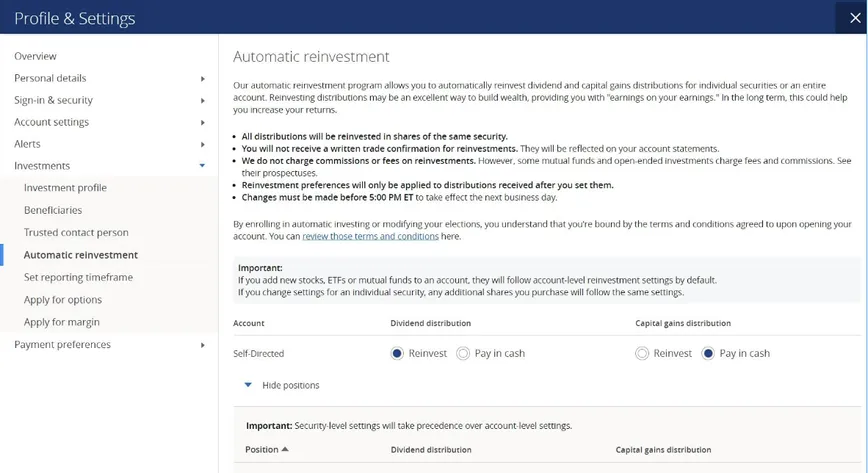

If you want to start reinvesting your dividends, you won’t be able to set this up through the Chase Mobile app. Instead, head to the Chase website and look for the Automatic reinvestment option in your Settings.

Choose what you want to do with any dividends or capital gains for all stocks, ETFs, and mutual funds in your account. Or decide whether you want to reinvest for individual securities.

There’s no fee for Chase’s DRIP feature. In fact, there’s no commission at all when trading stocks, ETFs, and options. But you could still run into third-party fees charged by the mutual funds themselves.

The main downside is that it’s difficult to get a feel for the platform in advance as there’s no demo account. And if you do later decide you want to transfer to a different broker, you’ll face a $75 termination fee.

- The Wealth Plan feature helps you with retirement planning

- DRIPs available for mutual funds

- Access to expert advisors

- Get up to $700 free when opening a Self-Directed Investing account

- You can’t access the DRIP settings on the mobile app

- No demo account and a $75 termination fee

Vanguard

| Minimum deposit | $0 |

| Stocks commission | $0 |

| Fractional shares? | Yes |

| DRIP fees | $0 |

| Demo account? | No |

Vanguard is affordable for any size portfolio given the low expense ratio of its funds and its no-commission online trading. However, the best benefits are reserved for biggest balances.

Those with over $1 million can expect exclusive resources and personalized investment advice from experts. They can also avoid fees when placing trades by phone.

Enrol in dividend reinvestment during your application, or else access your account online or by phone. You can find the option under Profile & Settings in your Account Information. There’s no fee or commission for the service.

Vanguard has a wide selection of stocks, ETFs, closed-end mutual funds, FundAccess funds, and Vanguard mutual funds—all eligible for dividend reinvestment. You’ll receive fractional shares rounded to three decimal places.

Wondering what other investment products and services to expect? Well, Vanguard also offers money market, CDs, and bonds. You’ll get a choice of account types—IRAs, small business retirement, 403(b), 529 saving plans, and more. Plus, there’s a robo-advisor service.

- DRIPs available for a variety of funds

- Fund expense ratio is 83% lower than industry average

- Reinvest all your dividends thanks to fractional shares

- Accounts and plans to suit a range of investors

- Modest portfolios can’t access the best services

- Some of the mutual funds have high minimum investment requirements

E*Trade

| Minimum deposit | $0 (minimum investments apply for prebuilt portfolios) |

| Stocks commission | $0 |

| Fractional shares? | Yes |

| DRIP fees | $0 |

| Demo account? | No |

Last but by no means least comes E*TRADE, which merged with Morgan Stanley in 2020. If you’re drawn to DRIP investing because you like the hands-off approach, then this is the platform for you.

As well as DRIP, E*TRADE offers managed portfolios. They let you leave investment decisions to experts or a combination of human and robo-advisors. Then there’s Automatic Investing. This lets you set up recurring investments in your retirement or brokerage account.

It’s simple enough to automate dividend reinvestment. Just click the dividend reinvestment icon in your portfolio. You’ll be able to choose individual shares to reinvest in or apply settings to your entire portfolio. Your full dividend amount will be invested as E*TRADE gives you fractional shares.

You’ll get a decent range of investment choices at E*TRADE. These include futures, options, mutual funds, bonds, CDs, and IPOs. Even better, there’s no commission on stocks, ETFs, and mutual funds.

Things you should be aware of are that the prebuilt portfolios come with an investment minimum of $2,500 for ETFs. Also, only stocks above $5 are eligible for a DRIP, and some users have complained of having difficulty turning off their DRIPs.

- Take advantage of prebuilt and managed portfolios

- Get access to multiple asset types, including IPOs

- No fees for stock trading or DRIPs

- Access to Morgan Stanley’s expertise and thought leadership

- Prebuilt portfolios require minimum investments of $500 or $2,500

- Some users have reported difficulty changing their DRIP settings

Best DRIP Brokers Compared

Here’s a side-by-side comparison of all the best DRIP brokers:

| Broker | Min deposit | Commission | Fractional shares? |

|---|---|---|---|

| Interactive Brokers | $0 | Up to $0.005 | Yes |

| Charles Schwab | $0 | $0 | Yes |

| Fidelity | $0 | $0 | Yes |

| Robinhood | $0 | $0 | Yes |

| JP Morgan Chase | $0 | $0 | Yes |

| Vanguard | $0 | $0 | Yes |

| E*TRADE | $0 | $0 | Yes |

How We Picked & Tested the Best DRIP Brokers

We looked for brokers that had the most to offer to DRIP investors. Here are some of our top priorities.

- Reinvestment options – This is obviously important. The best DRIP brokers will let you turn on a DRIP for your whole portfolio or pick individual securities. They’ll offer fractional shares so you can reinvest all your dividends. Some may even let you pool your dividends to invest in another asset.

- Asset offering – The ideal broker will give you plenty of choice. You should be able to reinvest dividends from a large range of stocks and ETFs. We also included some brokers that offer DRIPs on mutual funds. To build a diversified portfolio, you’ll want a broker that offers other assets too, like bonds, CDs, crypto, and derivatives.

- Ease of use – Using your broker should be simple and enjoyable. We looked for platforms that let you turn on a DRIP in a couple of clicks. Placing trades and navigating the platform should be an intuitive experience. We also selected brokers with a user-friendly mobile app for investing on the move.

- Other features – Chances are that reinvesting dividends isn’t the only thing you want to do. We prioritized brokers that have something else to offer, be it advanced trading tools, financial advice, retirement planning, banking services, or educational resources.

What is Dividend Reinvestment?

Reinvesting your dividends is a popular way to compound the growth of your investments. It can be really simple and hands-off, too, if your online broker offers a free dividend reinvestment plan (DRIP). Let’s take a closer look at how they work.

How DRIPs Work

If you hold a company’s stock, ETF, or mutual fund that pays cash dividends, you could reinvest that cash to buy more of the asset. Instead of buying more assets every time you get a dividend payout, brokers can automate this process through a dividend reinvestment plan (DRIP).

What is a dividend?

A dividend is a reward distributed to all the shareholders of a company. It can be distributed as cash or more shares and usually comes from the company’s profits. A company’s board can decide whether and how much to distribute as dividends. Distributions usually take place every quarter.

The broker will take the cash dividends of all investors enrolled in the DRIP and use them to buy more shares in the companies or funds that paid the dividends. Those extra shares will then be distributed proportionately to the accounts of everyone enrolled in the DRIP.

Some brokers may only reinvest your dividends if you have enough to purchase a whole number of shares. In most cases, though, brokers can provide you with fractional shares. This means the full amount of your dividends can be reinvested, and you may end up with a piece of a share.

With most brokers, you can turn on a DRIP for individual stocks. Alternatively, they’ll let you turn on a DRIP for your whole portfolio. This would reinvest the dividends of all your current and future eligible assets.

Example of a DRIP

Imagine you own 300 shares of Apple (AAPL) and you enroll in a dividend reinvestment plan. Apple decides to pay its shareholders a dividend of $0.85 per share, meaning you’ll earn $255.

But as you’re enrolled in the DRIP, you’ll receive your dividends in extra shares instead of cash. If AAPL is currently worth $170, you’ll receive 1.5 shares of AAPL for your $255. You now have 301.5 shares of AAPL.

The next quarter, there’s another dividend payout of $0.85 per share, meaning you’ll earn $256.275 ($0.85 x 301.5). For the sake of simplicity, let’s say that AAPL is still worth $170. This time, you’ll receive an extra 1.5075 shares. You now own a total of 303.0075 shares of AAPL.

How to Get Started with DRIP Brokers?

It’s pretty straightforward, really, as most of these platforms are very user-friendly. But if you want a clearer idea of what’s involved, here’s how to get started with Interactive Brokers.

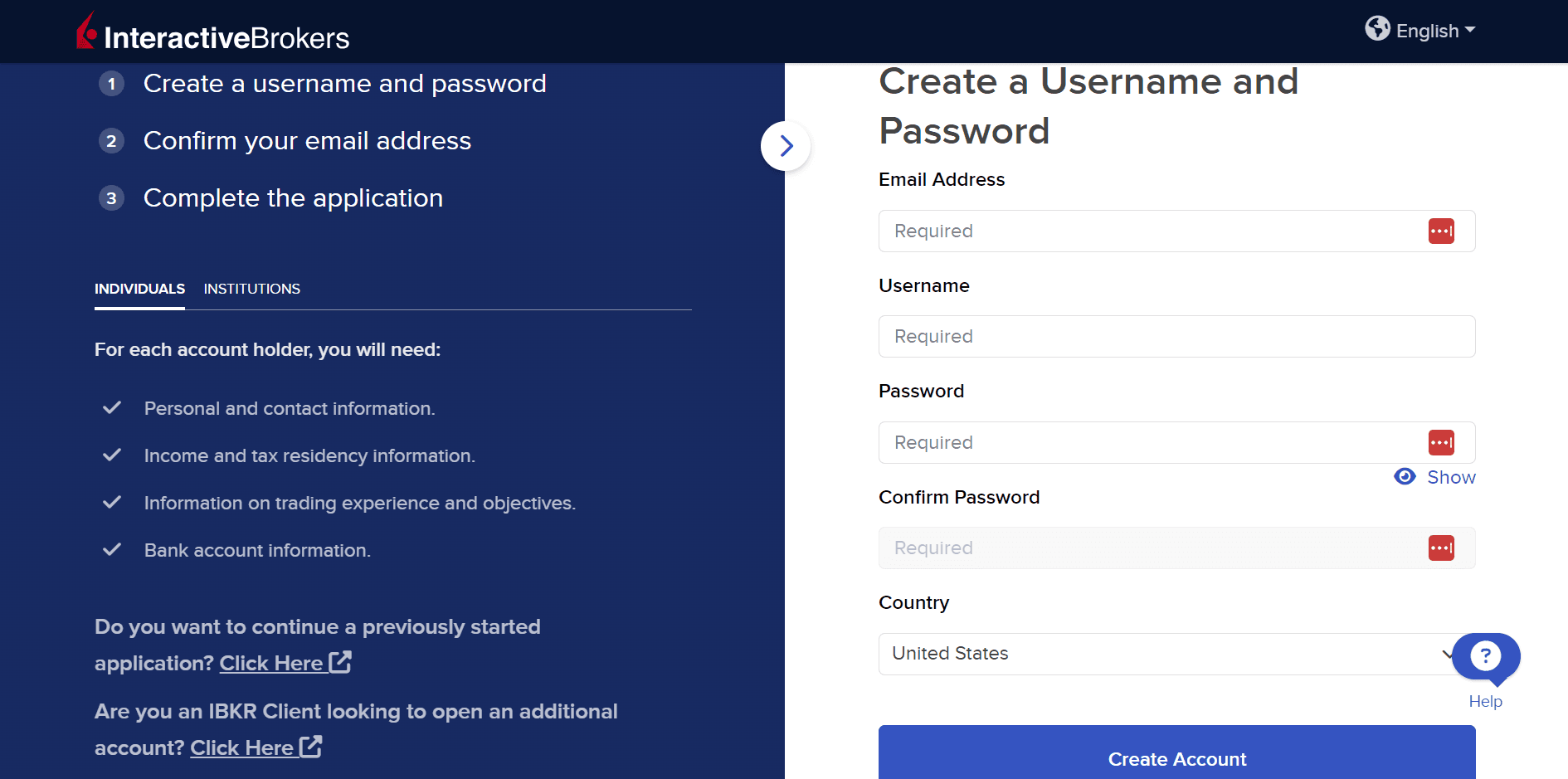

Step 1: Sign up

Head over to the official Interactive Brokers website and provide an email address, username, and password. You’ll need to verify your email address before your account can be approved.

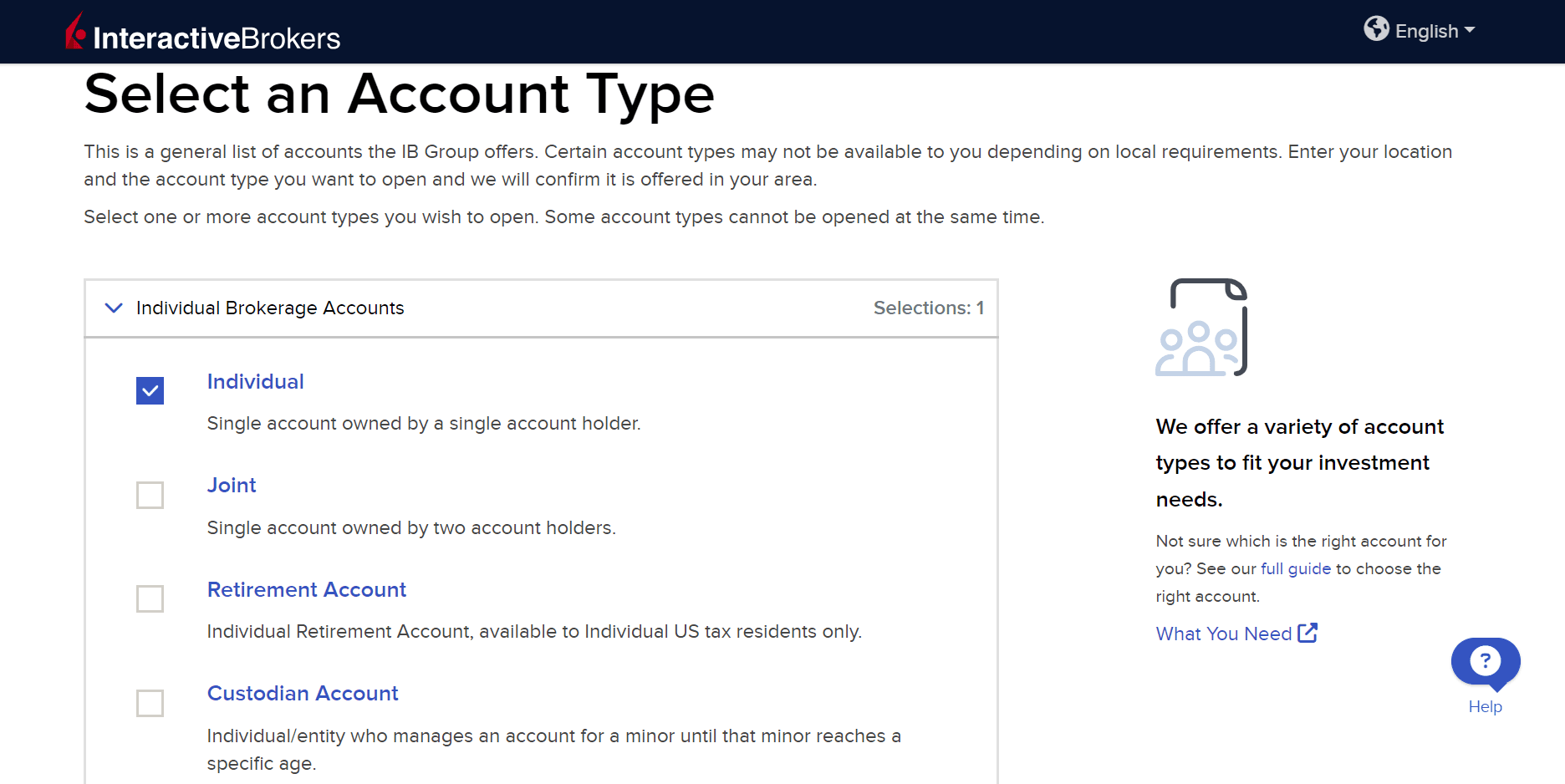

Step 2: Choose your account type and plan

Select one or more types of investment accounts. These could include individual, joint, retirement, or custodian for brokerage accounts. You’ll then need to choose your state and decide whether you want the IBKR LITE or IBKR PRO plan. LITE is cheaper for casual investors, while PRO would suit advanced traders. Once you’ve made your selection, click on the Start Application button.

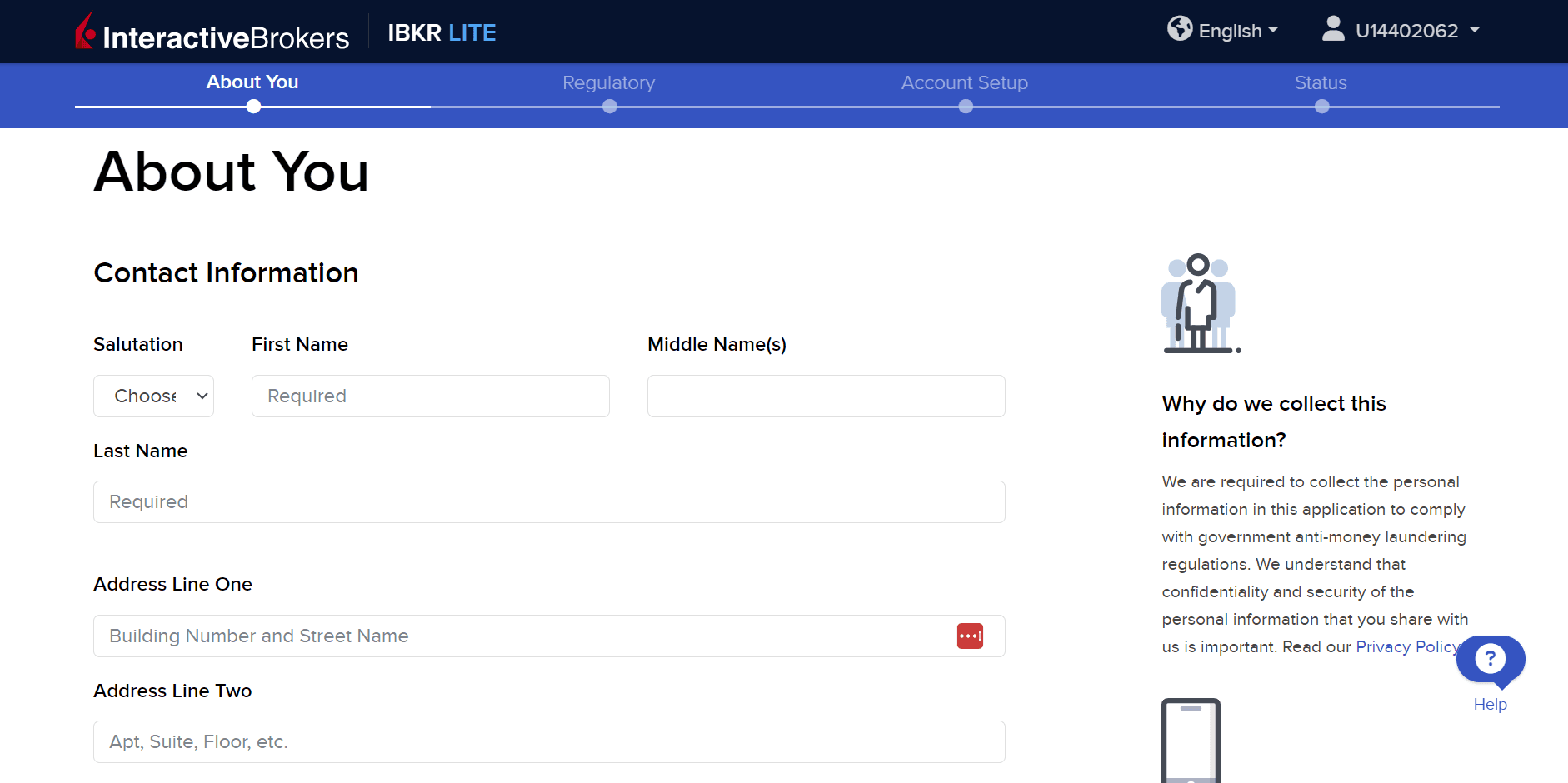

Step 3: Complete your application

Interactive Brokers will ask you for a lot of details, such as your contact details, personal information, employment information, source of wealth, and security questions. Make sure you have your Social Security Number and employer contact details to hand as you’ll need them. You’ll need to verify your mobile number before you can progress.

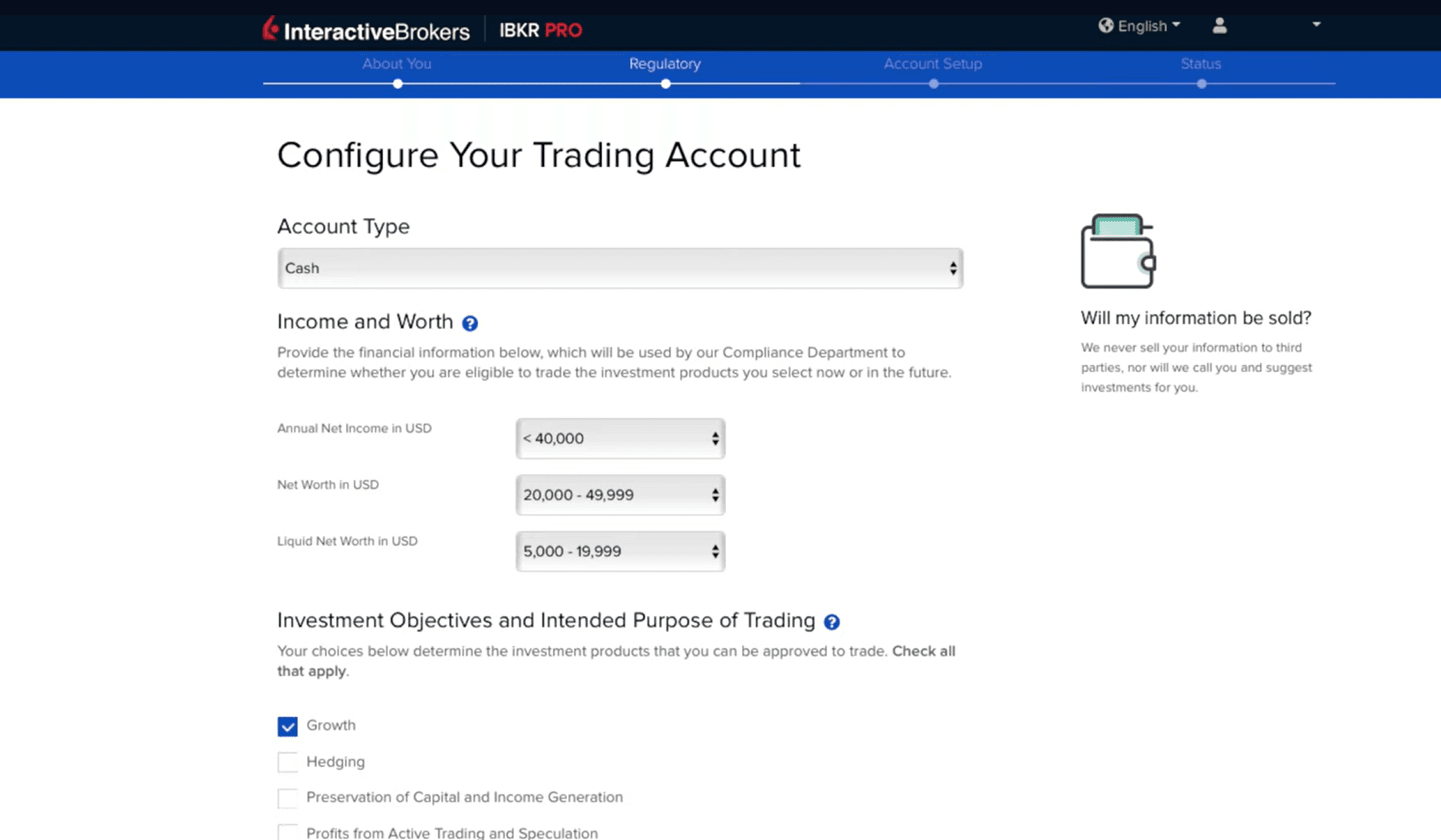

You’ll then need to choose whether you want a cash or margin account and provide details about your net worth, investment objectives, and trading experience.

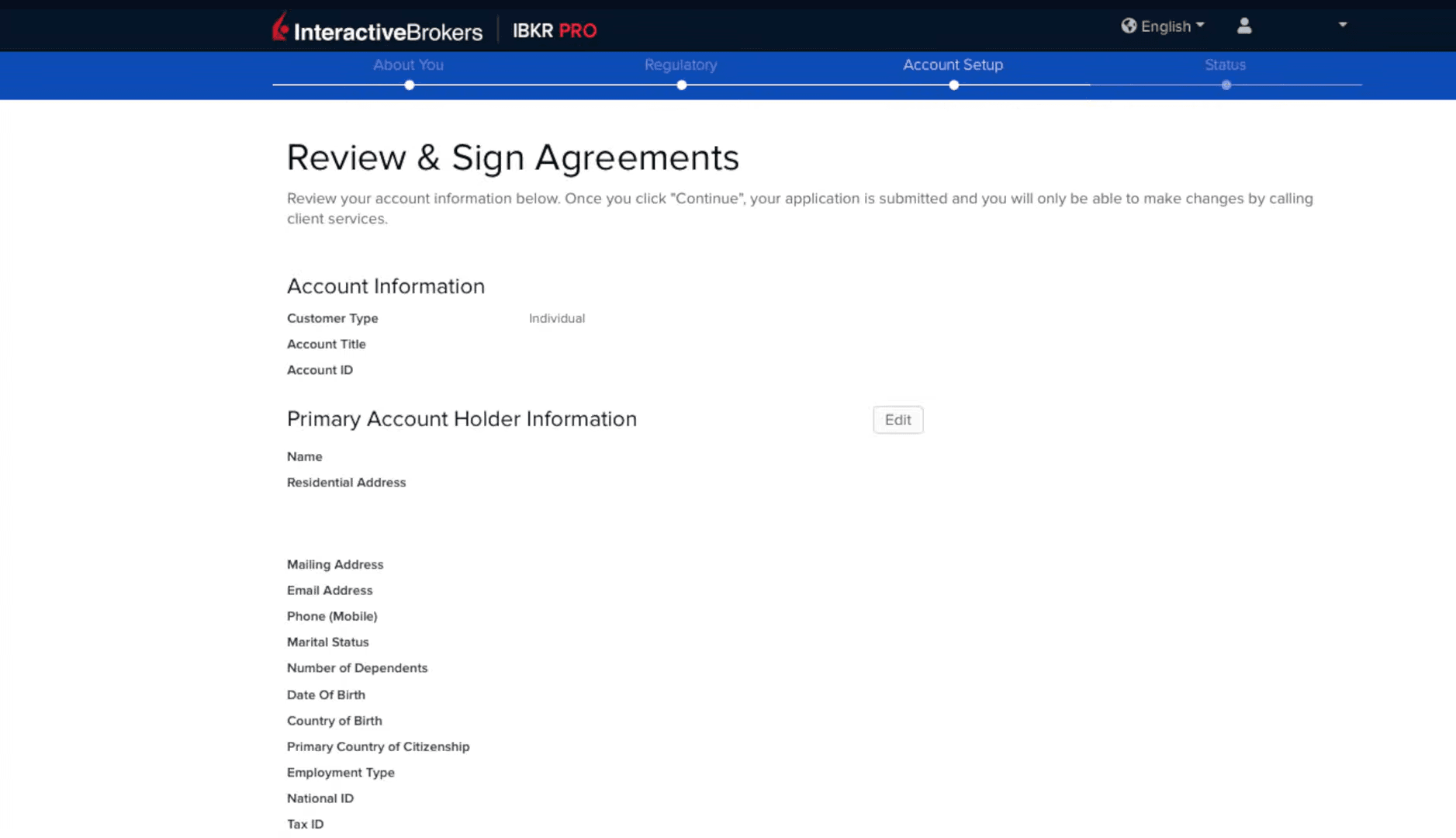

You’ll then need to review the information you’ve provided and tick all the agreements and disclosures. Sign your name at the bottom and click continue.

You’ll then need to wait until your application is approved. You may be asked to provide a photo ID or other documents in the meantime. If everything goes smoothly, your account might be approved in minutes. But you may have to wait days for approval.

Step 4: Fund your account

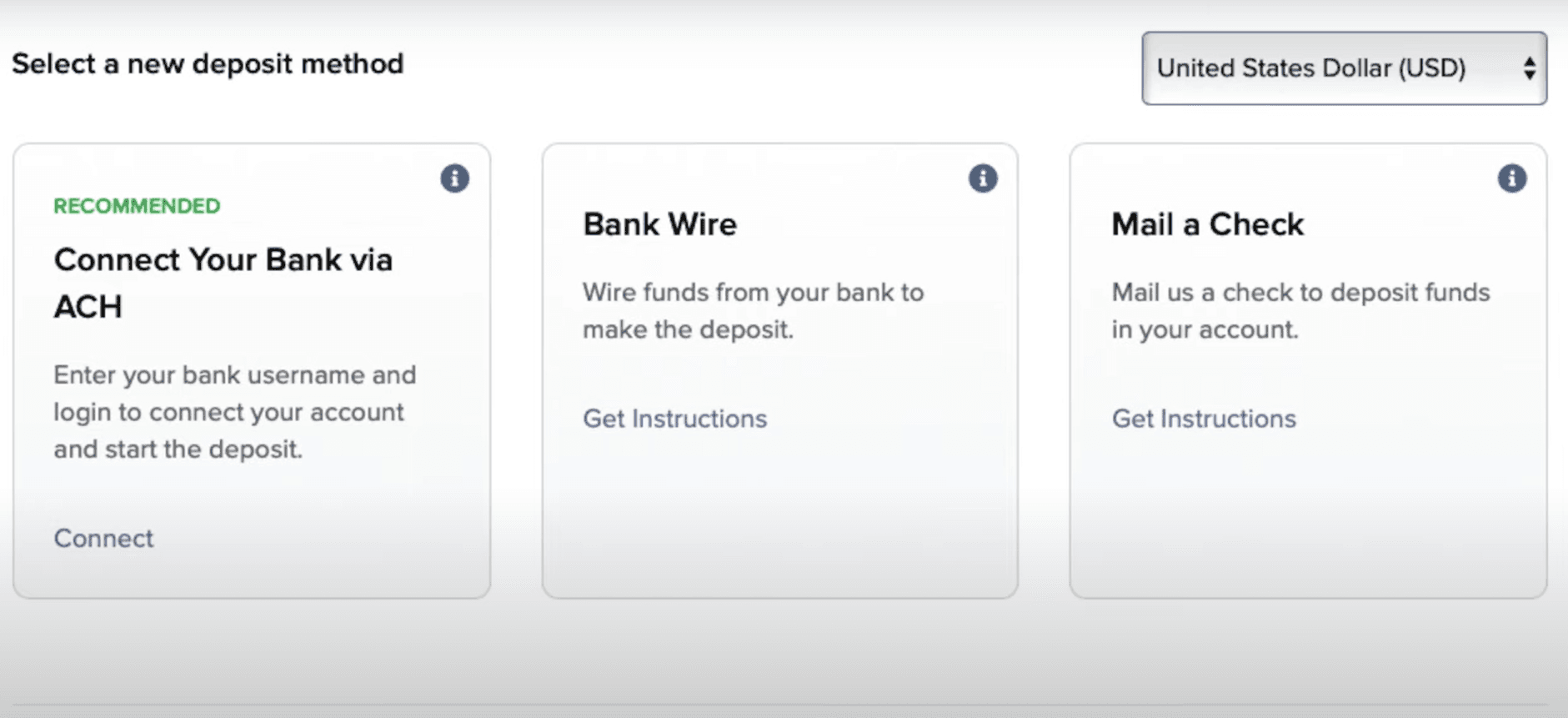

Once your application has been approved, you can log into your account and click the Deposit button under your portfolio on the left. You can choose ACH, wire transfer, or check. Just click your preferred option to see deposit instructions.

Step 5: Enable fractional shares

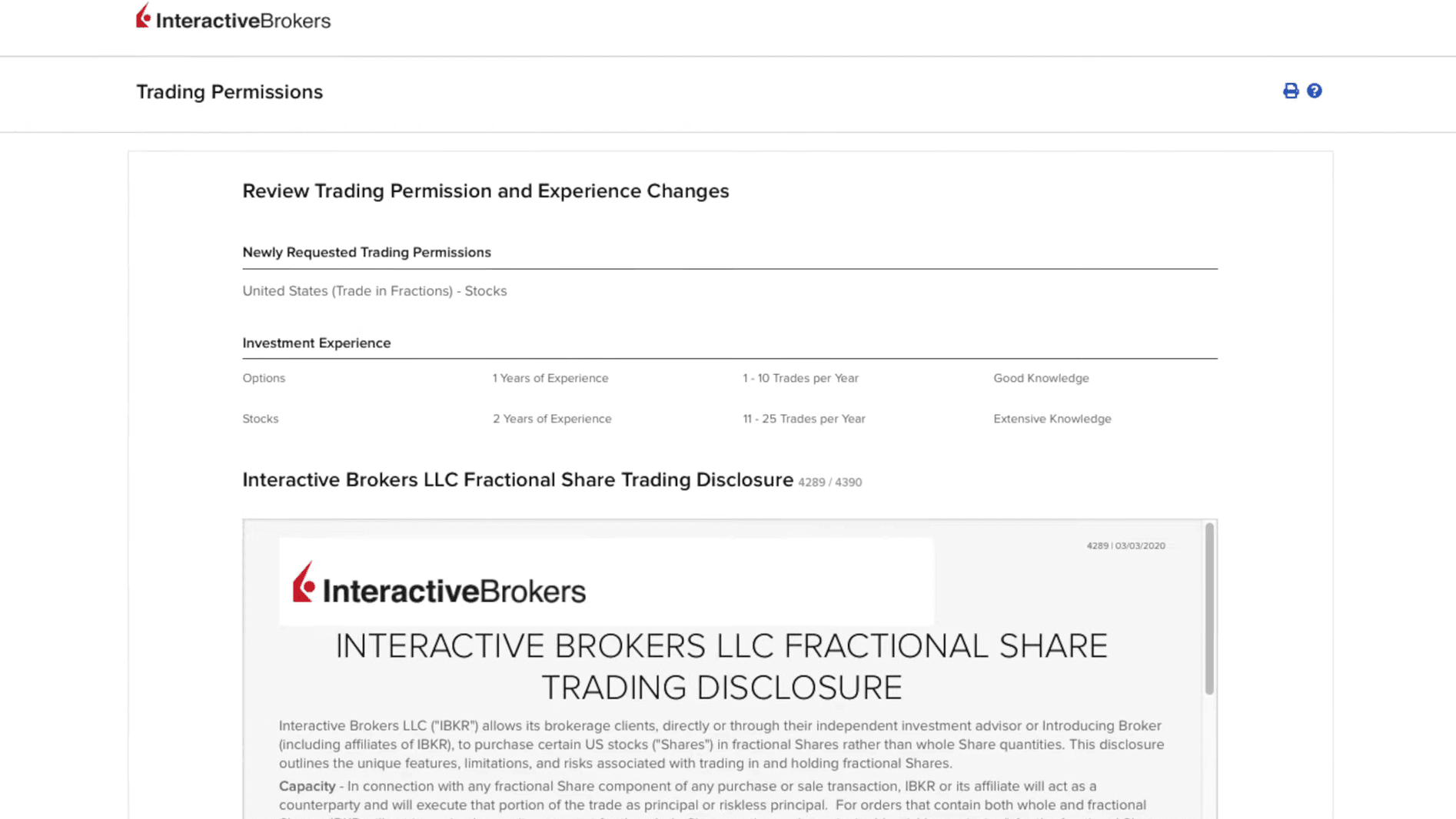

If you want to be able to invest your full dividend amount, regardless of whether it’s enough to purchase a whole number of shares, you’ll first need to enable fractional trading. Click the user menu and go to Settings. Under Account Settings, find the Trading section and click on Trading Permissions. Find Stocks, click +Add, and tick the box for Trade in Fractions. You’ll then need to digitally sign the fractional share trading disclosure.

Step 6: Enable dividend reinvestment

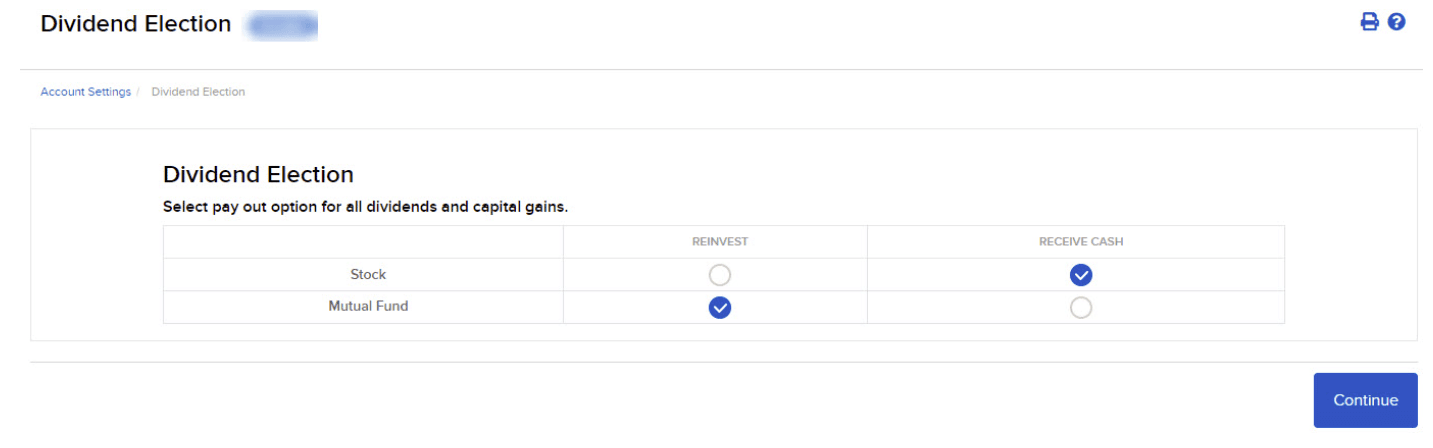

Click the user menu in the top right and go to the Trading section under Settings. Go to Dividend Election. For stocks and mutual funds, tick either reinvest or receive cash. Your choices will then apply to any current and future dividend-paying stocks or mutual funds in your account.

Start With the Champions

If you want to make some cash from stocks, diving into the Dividend Champions is a solid move. These 139 stocks have been upping their dividend payouts for at least 25 years straight.

We've rounded up a full, up-to-date list of all the current Dividend Champions for you. You can grab it below, along with plenty of handy stats to check out their performance. You can also track your investments using our custom-made Dividend Champions Spreadsheet.

Dividend Reinvestment Strategies

There’s more than one investment strategy for automatically reinvesting dividends. Here are your main options and what they entail.

Ways to Enrol

Decide whether you want to enrol in DRIPs operated by your broker or individual companies. Each option has its own pros and cons.

Broker-operated DRIP

You can do this through any of the brokers in this guide. Look for dividend reinvestment in your account settings and enroll. The broker will handle everything for you. It will purchase the additional shares and add them to your account.

Company-operated DRIP

Some companies operate their own dividend reinvestment plans. You may be able to avoid using a broker and buy shares directly from the company with a direct stock purchase plan (DSPP).

Enrolling in a company-operated DRIP means you can avoid broker trading commissions. Companies may also offer a discount on the current share price. However, this option is less convenient if you want to reinvest dividends for multiple companies.

Ways to Reinvest

Now let’s look at your options for where to invest your dividends.

Individual Stock Reinvestment

This is the most common option and what you’ll find offered by the online brokers on this page. It means that any dividend you receive is reinvested into the same stock that paid it. The downside of this strategy is that it doesn’t take the current stock price into consideration. This means that your dividends won’t necessarily be purchasing the best stocks at the best times.

Pool and Deploy

This strategy lets you optimize your investments. You let the dividends accumulate in cash in your account and then decide when and how you want to invest them. This means you can buy whatever asset is most undervalued or promising at the time.

There are downsides, though. You’ll have to implement this strategy manually, meaning more effort on your part. There’s also more chance of cash sitting idle in your account.

Portfolio Reinvestment

This is a newer strategy that is best employed with a broker that offers this specific feature, like M1. You simply decide what your ideal portfolio balance is. Whenever you receive dividends, your broker invests them such that your portfolio automatically rebalances to your ideal allocation.

How Do I Set Up a Dividend Reinvestment Plan With a Broker?

This may vary a bit from one broker to another, but it’s usually pretty straightforward. In some cases, DRIP enrolment may be part of the application process. You could also contact your broker by phone or email to ask to be enrolled.

However, in pretty much every case, you can set up a DRIP online. If you can’t find it in the app, try the website as it may have more features. The DRIP will usually be somewhere in your account settings.

It will probably be labeled ‘Dividend Reinvestment’ or ‘Dividend Election’. Just click this section and choose whether and how you want to reinvest your dividends.

Pros and Cons of Using Brokerages for DRIPs

- Asset variety – You’ll get access to lots of stocks, ETFs, and maybe mutual funds

- Ease of use – It’s usually as simple as clicking a button then reinvestment will be automatic

- Diversification – It’s much easier to spread your risk with a broker than company-operated DRIPs

- Useful features – Brokers offer lots more, like charts, research, and trading tools

- Cost – Some brokers may charge a commission, and you won’t get discounts on share price

- Limited strategies – Individual stock reinvestment will be your only option with many brokers

Do I Pay Taxes on Reinvested Dividends?

Yes. Dividends are considered taxable income regardless of whether they’re reinvested. This means you need to report them to the IRS on your tax return. Keep accurate records of the amount reinvested, the number of shares bought, and the purchase date.

You must report reinvested dividends as income according to their fair market value when purchased. Report them along with any other dividends on Form 1040. You’ll need to complete Schedule B (Form 1040) if your ordinary and reinvested dividends add up to more than $1,500.

What to Consider When Looking for a DRIP Broker

Still on the hunt for your ideal DRIP broker? Here are some questions you need to ask before deciding whether a broker is the right one for you.

What are the fees?

Of course, we all like to save a buck when we can. Thankfully, most DRIP brokers don’t charge commissions on stocks nowadays. But there may still be a cost for other services. Check out whether and how much you’ll need to pay for deposits, withdrawals, non-stock trading, subscriptions, inactivity, margin, and other fees.

Which assets are available?

Think about what you might want to invest in. If you just want to stick to major US stocks, any platform could serve you well. But your choice of brokers may be more limited if you want to set up DRIPs on mutual funds or obscure or foreign stocks. Think about assets that don’t have DRIPs, too. Are you interested in bonds, futures, commodities, crypto? This could help you rule out a few options.

Does it offer fractional shares?

This can be pretty crucial for smaller portfolios. You’ll want a broker that will let you reinvest in fractional shares instead of making you wait until you have enough cash to buy a whole number. Thankfully, all the brokers on this page offer this. But some only offer fractional shares in their DRIP and will make you buy and sell whole numbers otherwise.

What kind of accounts are there?

Depending on your financial goals, you might need a specific account. For example, if you want to set up a DRIP to fund your retirement, you might want a broker that offers tax-advantaged retirement accounts, like IRAs.

Is it easy for me to use?

A broker isn’t much use if you don’t understand how to use the platform. If it’s overly complicated, there’s a greater chance that you could make a costly mistake. Make sure you choose a broker to match your experience level. It’s a good idea to spend some time familiarizing yourself with the platform before you make any trades.

What other features are there?

If dividend investment isn’t your only goal, check a broker will meet your other needs. Are you a technical trader? You’ll likely want customizable charts and technical indicators. Like to do fundamental analysis? Make sure your broker provides the latest news and research. Or maybe you’re a new investor with a desire to learn. In that case, find a broker with a good offering of educational resources.

Should You Use DRIP Investing Brokers?

If you’re looking for an easy way to reinvest your dividends, then a DRIP broker is your best bet. Sure, company-operated DRIPs might give you a slight discount. But that doesn’t make up for the simplicity, diversification, and functionality you’ll get when DRIP investing through a broker.

It’s fine if DRIP investing is just one string to your financial bow. These brokers will help you with a ton of other stuff, from trading multiple asset types to education, spending, and retirement planning.

Interactive Brokers comes out at the top of the pile for us. Not only is the DRIP feature super easy to use, but you’ll also get global market access with some of the most powerful trading tools to boot. Commission-free stock trading and passive income opportunities are just the icing on the cake.

FAQs

This is a personal choice. Reinvesting dividends could grow your portfolio faster due to the effect of compounding returns. On the other hand, cash is safer and more liquid so it’s easier to withdraw or invest in something else. Really, it comes down to your risk tolerance and aims.

This depends on what you’re looking for. Fractional shares are usually a key feature to look for. You might also want to check for low fees, a wide range of assets, an intuitive mobile app, and extra features.

The amount you receive in dividends is usually a small fraction of the amount you have invested in that stock. It might be somewhere between 2% and 5% for strong dividend stocks. However, if your investments increase in value over time and you compound that growth with dividend reinvestment, it could eventually add up to a substantial portfolio.

Any stock, ETF, or mutual fund that pays dividends may be eligible for dividend reinvestment. However, certain brokers may impose restrictions on the types, locations, and prices of assets that are eligible for their DRIP.

It’s usually as simple as turning off the dividend reinvestment feature in your account settings. If you’re having trouble, contact your broker.

If you already have an oversized allocation to particular assets, you might want to avoid reinvesting their dividends and pushing your portfolio further out of balance. Taking dividends as cash gives you a chance to diversify and avoid buying stocks when they’re doing badly. Also, you might want to use cash dividends as a source of income if you’re retired.

If your shares are bought through a company-operated DRIP, you might get a bit of a discount. Shares bought through a broker-operated DRIP are simply bought at the current market price. As for whether that is a good price, it’s somewhat subjective. You could look at technicals like the Relative Strength Index or fundamentals like company earnings reports to judge whether a share is under or overvalued at a given moment. If you want to only make purchases at the most opportune and undervalued times, then don’t use a DRIP. If you want to dollar cost average and build your portfolio while reducing the effects of price volatility, then a DRIP could be a good choice.