Dividend Reinvestment Programs have been a staple for acquiring shares for years. An alternative that supersedes this option is holding shares through a broker that offers the same advantages. It is instructive to evaluate this option to determine if this DRiP still has a place for the dividend investor.

A question that has been asked on numerous message boards is whether or not the idea of dividend reinvestment programs is dead. While there are gradations of nuance within the question itself, the answer is that yes, they are dead. The idea, itself, is solid for dividend investors, but the execution is lacking.

I will expand on this to assure the reader of the exact reasons for my opinion.

Dividend reinvestment programs go back many years. My grandfather was an engineer for AT&T. I am not sure of the exact years, but probably from about 1925-1965. AT&T, as well as numerous other companies, encouraged their employees to purchase stock in their company and made it easy for them to do so.

There were many reasons for this, but one of the best was to give employees some “skin in the game.” If the company did well, then the shareholders did well. Employee shareholders had added incentive to perform their best for the good of the company.

My grandfather participated in AT&T’s dividend reinvestment program, and when he passed away, my mother got half of the stock that had accumulated. My parents used that money to build a house that my father designed (he was an architect). This was an excellent example of the strength of setting a little aside regularly over a long period of time.

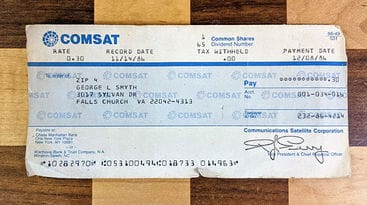

I somewhat participated in one 35 years ago. When I worked for Comsat, one of my benefits was to receive stock in the company. At the time, I knew nothing about investing and was a little confused when I would occasionally receive a check for a pocketful of change. Eventually, the company laid off a bunch of us and I stopped receiving those mystery checks.

I began earnestly investing in the early 1990s, and upon reading an article in The Motley Fool about DRiPs, I became immersed with the idea. It made so much sense to make small purchases regularly. I saw what my grandfather had accomplished and decided to go that route.

This resulted in becoming a weekly author for the website. When Internet companies fell apart in 2000, they purged the paid authors on the website, the company decided to charge admission to their message boards, and I created DRiPInvesting.org.

This is a long explanation to show that I appreciate the strength of dividend reinvestment programs and stress the importance they have had in my life, as they were instrumental in allowing me to retire years seven years before taking Social Security. But like any tool, despite its success in the past, its continued use constantly needs to be reassessed.

Today there are advantages to using a discount broker instead of starting a traditional DRiP. To successfully do so, the broker must have the ability to offer the two things that make DRiPs so attractive.

- Make fee-free purchases

- Automatically reinvest dividends

I will look at these one at a time.

Make fee-free purchases

My grandfather did not have to pay a fee to make AT&T stock purchases through the company. Over 20 years ago, when I found an interest in DRiPs, many companies allowed share purchases without cost. As the popularity of these programs increased, many of these companies decided to charge for purchases.

These fees came not only in the form of purchases of new shares, but sometimes even in the purchase of shares through dividend reinvestment! When I first started to see this happen, it was hard to believe. Even my beloved Coke, a company created by a distant relative, Asa Griggs Candler, and one that I had held for many years, attending numerous annual meetings (and meeting Warren Buffet), began to charge such fees.

For years, I wrote about the many quality companies that offered fee-free DRiPs and pointed people to MoneyPaper (now directinvesting.com). Now I see the company offers enrollments for only 55 fee-free DRiPs. The trend has become painfully obvious.

Numerous discount brokers allow the purchase of equities without cost. When I started investing in 1992, purchasing stock (if I remember correctly) cost $29.95 at Schwab. I remember going to their office in Annapolis twice to make purchases. Now purchasing through them is free. I use Ally, but TD Ameritrade, Fidelity, and many others offer the same thing.

Automatically reinvest dividends

It happens regularly, where I get an email from Ally letting me know that I have received a dividend. It is a real pleasure to log into my account to see how many additional shares have been purchased automatically and added to my account.

This is a more recent innovation that has, in my opinion, nailed shut the coffin of dividend reinvestment programs. For many years one needed to manually purchase whole shares only after accumulating enough cash through dividends. One advantage of DRiPs was that the program did this automatically, and purchases were made for whole and fractional shares. Now that discount brokers offer the same ability, this advantage previously unique to DRiPs is now common.

But Will It Last?

I asked myself this question when I first became aware that brokers offered everything the traditional DRiP offered. After all, I had seen the coming and going of companies like BuyAndHold.com, which initially offered free purchases, then charged monthly fees, then went out of business.

Zecco is another broker that initially offered free stock purchases, then decided to charge. I am with Ally because I originally created an account with Zecco to get free trades, and Ally acquired Zecco, which eventually decided to go fee-free.

Things change over time. Small companies may attempt to build a business model on innovation, but oftentimes that model is either flawed or does not offer enough of a revenue stream to continue. Sometimes companies are just too early with their ideas. However, when the big boys make a change, like going fee-free, it becomes the standard, and I do not expect this to be changed any time soon.

The Biggest Problem With DRiPs

The major problem with DRiPs – and this existed when I first started participating in them – is that one can only enter a DRiP as a shareholder. That is a true barrier to entry.

Long ago, I wrote a series of articles that explained how to get a share, making entry into the program possible. To the uninitiated, purchasing shares through a broker does not make one an actual shareholder. When you purchase through a broker, the broker owns the share for you. The broker is the actual owner of the share.

If you want to become the actual shareholder, you need to request that a physical certificate be sent to you. Once obtained, you are the legal shareholder and become eligible to participate in the dividend reinvestment program. For years at DRiPInvesting.org, we kept track of discount brokers who would send the certificate for a small fee, but these days one is looking at around $100 to have a physical certificate mailed (if the service is even offered).

directinvesting.com used to offer a service that would make the initial purchase for you, then enroll you in the company’s dividend reinvestment program. I have mentioned them many times and long ago used their service. However, now they are sending people to Temper of the Times, which I believe to be a spinoff of the company. I did not have the patience to read through all of the text on their website to figure out the actual cost of getting enrolled in the DRiP, so if you are interested, then have at it.

Canadians do not have as easy a time of this as we do in the United States. For this reason, I created a Share Exchange message board that was for their exclusive use, where participants could offer shares to other participants. If you use it, then do so at your own risk. The board is on Google Groups – when it was on DRiPInvesting.org, it was popular and successful, though one should understand that there can always be problems and disagreements.

Finishing Up

I still have four classic DRiPs from when I first started investing in this direction. I will be moving them over to Ally at some point soon. There is no major advantage to do so, besides the fact that instead of getting quarterly reports, I am now receiving yearly reports. Unless I log into Computershare’s system, this information will be a mystery to me until January of next year, when they will send me the information for my taxes.

Not being one to worry or stress over the exact amount of shares I own, it is not a major issue. I do not have plans to sell and will almost certainly hold onto the shares for a long time, allowing them to accumulate over that time. On the one hand, it would be a bit more convenient to see all of my equities in one place. On the other, according to Dividend Growth Investor, a Fidelity study showed their best performing investors to have been those who did nothing with their accounts.

I do not see any advantage a dividend reinvestment program has over holding a stock with a broker that succeeds in both of the two issues noted above. Actually, going the traditional DRiP route is time-consuming and more expensive, so yes, dividend reinvestment programs are dead.