The Dividend Investing Resource Center

Discover how Dividend Reinvestment Plans (DRIPs) can amplify your investment portfolio by automatically reinvesting company dividends into additional shares.

By leveraging the power of compounding, you can escalate your shareholdings over time.

What is dividend investing?

Dividend investing is a means of building wealth over a long period of time with reduced risk.

Many brokers offer fee-free purchases and reinvestments and the ability to reinvest fractional shares.

Dividend investing is for the long term buy-and-hold type investor who wants to sleep at night while their investments steadily build.

What is DRIP?

The term DRIP is an abbreviation for dividend reinvestment plans, which offer investors the opportunity to reinvest all, or a portion, of their dividend payments back into a company’s stock. Oftentimes, companies will allow investors to purchase additional shares of stock through these programs too.

What is DRIP investing?

Dividend reinvestment plans are sponsored by companies that allow individual investors to purchase common stock without going through a broker. The name comes from the plan’s policy of allowing the investor to automatically reinvest dividends to purchase additional shares of stock.

Many DRIPs are offered to investors free of any participation costs, while others charge relatively small administration fees or commissions. While the name implies these plans are limited to reinvesting stock dividends, some plans allow participants to directly purchase a company’s stock. This enhanced practice is sometimes referred to as optional cash purchases or OCPs.

Advantages of DRIP

A large number of companies offer dividend reinvestment programs, and participation rules are usually outlined in the investor section of the company’s website. Since these plans are flexible enough to allow even small purchases without a broker’s fee, it’s hard to find any downside to these offerings. In fact, there are several significant advantages of these programs including:

Low cost of entry

Investors don’t need a lot of money to enroll in these programs.

Most companies allow the purchase of just a single share of stock, and often this purchase is at a discount.

Cost-effective

Since the investor isn’t paying brokerage fees, all of the money is put to work.

Over 100 companies allow investors to purchase stock at a discount to the current market price through optional cash purchase plans, or OCPs.

DCA

Finally, many of the DRIPs allow investors to purchase stock through automated weekly or monthly deductions.

This long-term purchase strategy provides the investor with a less painful, and more structured, approach to buying stocks.

CCC list

Most Popular Dividend Stocks

Here are some of the top-performing and most popular dividend stocks.

| Logo | Symbol | Stock Type | Company | Sector | Industry | Price | Div Yield | 5Y Avg Yield | Current Div | Payouts/Year | Annualized | Previous Div | Ex-Date | Pay-Date | Low | High | Chowder Number | DGR 1Y | DGR 3Y | DGR 5Y | DGR 10Y | TTR 1Y | TTR 3Y | FV (Peter Lynch) | FV (Peter Lynch) % | EPS 1Y | Revenue 1Y | NPM | CF/Share | ROE | Current R | Debt/Capital | ROTC | P/E | P/BV | PEG |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| VST | Challenger | Vistra Corp. | Utilities | Utilities – Independent Power Producers | $162.06 | 0.56% | 2.18% | $0.227 | 4 | $0.908 | $0.226 | Dec 22, 2025 | Dec 31, 2025 | $90.51 | $219.82 | 11.4 | 3.1% | 7.6% | 10.8% | — | 17.3% | 91.9% | $13.90 | 1,066.0% | 0.0% | 16.5% | 5.6% | $11.78 | 17.3% | 1.0 | 85.0% | 5.2% | 58.3x | 20.1x | 1.03 |

|

| AVGO | Contender | Broadcom Inc. | Technology | Semiconductors | $348.33 | 0.75% | 2.18% | $0.650 | 4 | $2.600 | $0.590 | Dec 22, 2025 | Dec 31, 2025 | $138.10 | $414.61 | 13.4 | 11.5% | 12.7% | 12.6% | 30.9% | 46.4% | 87.4% | $118.75 | 193.0% | 0.0% | 23.9% | 36.2% | $5.81 | 31.1% | 1.7 | 43.0% | 17.1% | 73.3x | 5.9x | 1.91 |

|

| LRCX | Contender | Lam Research Corporation | Technology | Semiconductor Equipment & Materials | $176.27 | 0.59% | 1.09% | $0.260 | 4 | $1.040 | $0.260 | Dec 3, 2025 | Jan 7, 2026 | $56.32 | $179.80 | 15.5 | 14.0% | 15.0% | 14.9% | 24.7% | 143.7% | 63.2% | $113.00 | 56.0% | 0.0% | 23.7% | 29.7% | $5.08 | 62.3% | 2.2 | 27.0% | 43.0% | 39.0x | 21.8x | 2.39 |

|

| LLY | Contender | Eli Lilly and Company | Healthcare | Drug Manufacturers – General | $1,077.72 | 0.56% | 1.04% | $1.500 | 4 | $6.000 | $1.500 | Feb 13, 2026 | Mar 10, 2026 | $623.78 | $1,111.99 | 15.7 | 15.4% | 15.2% | 15.2% | 11.6% | 39.4% | 44.6% | $509.25 | 112.0% | 0.0% | 32.0% | 31.0% | $17.95 | 96.5% | 1.6 | 63.0% | 35.1% | 52.9x | 40.6x | 1.39 |

|

| GS | Contender | Goldman Sachs Group, Inc. (The) | Financial Services | Capital Markets | $893.96 | 1.79% | 2.51% | $4.000 | 4 | $16.000 | $4.000 | Dec 2, 2025 | Dec 30, 2025 | $439.38 | $919.10 | 24.7 | 21.7% | 15.9% | 22.9% | 18.6% | 60.8% | 41.8% | $1,231.25 | -27.0% | 0.0% | 15.0% | 27.0% | $59.64 | 13.5% | 1.7 | 72.0% | 4.1% | 18.2x | 2.6x | 1.39 |

|

| OMF | Challenger | OneMain Holdings, Inc. | Financial Services | Credit Services | $68.38 | 6.14% | 13.50% | $1.050 | 4 | $4.200 | $1.040 | Nov 10, 2025 | Nov 14, 2025 | $38.00 | $70.17 | -0.7 | 1.2% | 3.1% | -6.8% | — | 48.3% | 41.2% | $147.50 | -54.0% | 0.0% | 5.3% | 14.6% | $25.64 | 21.4% | — | 87.0% | 2.8% | 11.6x | 2.4x | 0.56 |

|

| AMAT | Challenger | Applied Materials, Inc. | Technology | Semiconductor Equipment & Materials | $262.11 | 0.70% | 0.88% | $0.460 | 4 | $1.840 | $0.460 | Feb 19, 2026 | Mar 12, 2026 | $123.74 | $276.10 | 16.1 | 17.1% | 20.4% | 15.4% | 16.1% | 59.8% | 40.8% | $216.75 | 21.0% | 0.0% | 4.4% | 24.7% | $10.04 | 35.5% | 2.6 | 25.0% | 27.5% | 30.3x | 10.2x | 1.40 |

|

| JPM | Contender | JP Morgan Chase & Co. | Financial Services | Banks – Diversified | $325.84 | 1.84% | 2.75% | $1.500 | 4 | $6.000 | $1.400 | Jan 6, 2026 | Jan 31, 2026 | $202.16 | $330.86 | 10.9 | 20.7% | 11.5% | 9.0% | 12.7% | 40.3% | 38.9% | $505.00 | -35.0% | 0.0% | 12.3% | 31.6% | $-43.99 | 16.4% | — | 56.0% | 7.6% | 16.1x | 2.6x | 3.07 |

|

| CAT | Champion | Caterpillar, Inc. | Industrials | Farm & Heavy Construction Machinery | $576.79 | 1.05% | 1.97% | $1.510 | 4 | $6.040 | $1.510 | Jan 20, 2026 | Feb 19, 2026 | $267.30 | $627.50 | 8.3 | 7.7% | 8.1% | 7.2% | 7.1% | 62.1% | 36.7% | $454.61 | 27.0% | 0.0% | -3.4% | 14.3% | $24.66 | 46.3% | 1.4 | 57.0% | 20.0% | 29.6x | 13.1x | 1.50 |

|

| ORCL | Contender | Oracle Corporation | Technology | Software – Infrastructure | $195.26 | 1.02% | 1.41% | $0.500 | 4 | $2.000 | $0.500 | Jan 9, 2026 | Jan 23, 2026 | $118.86 | $345.72 | 15.7 | 18.8% | 14.1% | 14.6% | 12.8% | 17.9% | 36.0% | $133.25 | 47.0% | 0.0% | 8.4% | 25.3% | $7.76 | 69.0% | 0.9 | 80.0% | 12.6% | 36.6x | 18.7x | 4.34 |

|

| WMT | King | Walmart Inc. | Consumer Defensive | Discount Stores | $112.28 | 0.84% | 1.39% | $0.235 | 4 | $0.940 | $0.235 | Dec 12, 2025 | Jan 5, 2026 | $79.81 | $117.45 | 6.3 | 13.0% | 8.0% | 5.5% | 3.7% | 24.7% | 35.3% | $71.50 | 57.0% | 0.0% | 5.0% | 3.3% | $5.14 | 23.7% | 0.8 | 36.0% | 15.9% | 39.3x | 9.3x | 3.04 |

| IBM | Champion | International Business Machines | Technology | Information Technology Services | $305.01 | 2.20% | 4.61% | $1.680 | 4 | $6.720 | $1.680 | Nov 10, 2025 | Dec 10, 2025 | $214.50 | $324.90 | 3.7 | 0.6% | 0.6% | 1.5% | 3.4% | 43.5% | 35.1% | $209.75 | 45.0% | 0.0% | 1.4% | 12.1% | $14.42 | 30.2% | 0.9 | 67.0% | 9.4% | 36.4x | 10.2x | 4.98 |

|

| MS | Contender | Morgan Stanley | Financial Services | Capital Markets | $180.27 | 2.22% | 3.41% | $1.000 | 4 | $4.000 | $1.000 | Oct 31, 2025 | Nov 14, 2025 | $94.33 | $182.34 | 24.6 | 8.5% | 9.3% | 22.4% | 21.5% | 49.3% | 33.7% | $243.75 | -26.0% | 0.0% | 14.1% | 22.6% | $-2.31 | 15.1% | 2.3 | 77.0% | 3.8% | 18.5x | 2.9x | 2.63 |

|

| MFC | Contender | Manulife Financial Corporation | Financial Services | Insurance – Life | $36.64 | 3.45% | 4.99% | $0.316 | 4 | $1.264 | $0.306 | Nov 26, 2025 | Dec 19, 2025 | $25.92 | $36.93 | -2.3 | -46.9% | -15.2% | -5.8% | 1.7% | 23.9% | 32.8% | $37.72 | -3.0% | 0.0% | 9.3% | 18.5% | $18.22 | 11.8% | 32.2 | 23.0% | 9.8% | 16.1x | 1.7x | 1.91 |

|

| MPLX | Contender | MPLX LP | Energy | Oil & Gas Midstream | $53.97 | 7.98% | 11.67% | $1.077 | 4 | $4.308 | $0.957 | Nov 7, 2025 | Nov 14, 2025 | $44.60 | $56.26 | 15.5 | 12.6% | 11.0% | 7.5% | 8.8% | 31.9% | 32.1% | $118.00 | -54.0% | 0.0% | 5.8% | 37.6% | $5.99 | 34.1% | 1.3 | 63.0% | 13.7% | 11.4x | 3.8x | — |

|

| MAIN | Contender | Main Street Capital Corporation | Financial Services | Asset Management | $60.80 | 5.92% | 9.33% | $0.300 | 12 | $3.600 | $0.255 | Jan 8, 2026 | Mar 13, 2026 | $47.00 | $67.77 | 19.3 | 2.9% | 12.8% | 13.4% | 4.7% | 20.7% | 30.9% | $129.71 | -53.0% | 0.0% | 8.1% | 95.6% | $3.55 | 19.1% | 1.3 | 42.0% | 10.6% | 10.1x | 1.9x | — |

|

| AAPL | Contender | Apple Inc. | Technology | Consumer Electronics | $273.88 | 0.38% | 0.54% | $0.260 | 4 | $1.040 | $0.260 | Nov 10, 2025 | Nov 13, 2025 | $169.21 | $288.62 | 5.4 | 4.0% | 4.2% | 5.0% | 7.3% | 8.0% | 29.1% | $186.50 | 47.0% | 0.0% | 6.4% | 26.9% | $7.54 | 171.4% | 0.9 | 52.0% | 75.1% | 36.7x | 54.9x | 3.34 |

|

| HTGC | Challenger | Hercules Capital, Inc. | Financial Services | Asset Management | $18.78 | 10.01% | 14.28% | $0.470 | 4 | $1.880 | $0.470 | Nov 12, 2025 | Nov 19, 2025 | $15.65 | $22.04 | 16.4 | 2.2% | -1.5% | 6.4% | 4.2% | 13.7% | 28.9% | $43.50 | -57.0% | 0.0% | 7.2% | 60.1% | $-2.20 | 15.4% | 0.2 | 50.0% | 7.6% | 10.8x | 1.5x | 2.23 |

|

| MSFT | Contender | Microsoft Corporation | Technology | Software – Infrastructure | $487.03 | 0.75% | 0.84% | $0.910 | 4 | $3.640 | $0.830 | Feb 19, 2026 | Mar 12, 2026 | $344.79 | $555.45 | 11.0 | 10.4% | 10.2% | 10.2% | 10.2% | 14.8% | 27.7% | $351.25 | 39.0% | 0.0% | 14.9% | 35.7% | $19.78 | 32.2% | 1.4 | 13.0% | 27.0% | 34.7x | 10.0x | 2.27 |

|

| RY | Contender | Royal Bank Of Canada | Financial Services | Banks – Diversified | $171.52 | 2.64% | 3.93% | $1.132 | 4 | $4.528 | $1.066 | Jan 26, 2026 | Feb 24, 2026 | $106.10 | $171.84 | 2.9 | -21.0% | -5.5% | 0.3% | 2.9% | 48.4% | 26.9% | $256.75 | -33.0% | 0.0% | 16.2% | 29.8% | $-36.33 | 15.3% | — | 74.0% | 4.2% | 16.7x | 2.6x | 1.71 |

|

| COST | Contender | Costco Wholesale Corporation | Consumer Defensive | Discount Stores | $873.27 | 0.60% | 1.22% | $1.300 | 4 | $5.200 | $1.300 | Oct 31, 2025 | Nov 14, 2025 | $844.06 | $1,078.23 | -16.3 | 12.4% | 13.2% | -16.9% | -2.6% | -6.0% | 26.1% | $467.25 | 87.0% | 0.0% | 8.2% | 3.0% | $33.26 | 30.3% | 1.0 | 21.0% | 23.0% | 46.7x | 12.8x | 4.88 |

|

| RTX | Champion | RTX Corporation | Industrials | Aerospace & Defense | $184.77 | 1.47% | 2.42% | $0.680 | 4 | $2.720 | $0.680 | Nov 21, 2025 | Dec 11, 2025 | $112.27 | $188.00 | 8.7 | 7.7% | 7.3% | 7.2% | 5.2% | 63.6% | 26.0% | $121.75 | 52.0% | 0.0% | 17.2% | 7.7% | $5.94 | 10.7% | 1.1 | 38.0% | 6.5% | 37.9x | 3.8x | 4.14 |

|

| PM | Contender | Philip Morris International Inc | Consumer Defensive | Tobacco | $161.07 | 3.65% | 5.48% | $1.470 | 4 | $5.880 | $1.470 | Dec 26, 2025 | Jan 14, 2026 | $116.12 | $186.69 | 7.2 | 6.4% | 3.8% | 3.5% | 3.4% | 42.1% | 23.7% | $175.25 | -8.0% | 0.0% | 7.7% | 21.6% | $7.40 | — | 0.9 | 1.4% | 28.8% | 23.0x | —x | 2.17 |

|

| KMI | Challenger | Kinder Morgan, Inc. | Energy | Oil & Gas Midstream | $27.40 | 4.28% | 6.74% | $0.293 | 4 | $1.172 | $0.293 | Nov 3, 2025 | Nov 17, 2025 | $23.94 | $31.48 | 6.6 | 1.7% | 1.9% | 2.4% | -4.9% | 9.7% | 22.9% | $30.50 | -10.0% | 0.0% | -1.5% | 16.6% | $2.58 | 8.9% | 0.6 | 51.0% | 4.5% | 22.5x | 2.0x | 2.92 |

|

| BAC | Contender | Bank of America Corporation | Financial Services | Banks – Diversified | $55.75 | 2.01% | 2.55% | $0.280 | 4 | $1.120 | $0.280 | Dec 5, 2025 | Dec 26, 2025 | $33.07 | $56.55 | 10.5 | 8.0% | 7.9% | 8.4% | 18.4% | 31.1% | 22.9% | $91.50 | -39.0% | 0.0% | 3.4% | 26.3% | $8.42 | 9.9% | — | 53.0% | 4.9% | 15.2x | 1.5x | 1.09 |

|

| CSCO | Contender | Cisco Systems, Inc. | Technology | Communication Equipment | $77.74 | 2.11% | 3.16% | $0.410 | 4 | $1.640 | $0.410 | Jan 2, 2026 | Jan 21, 2026 | $52.11 | $80.82 | 4.8 | 2.5% | 2.6% | 2.7% | 7.1% | 36.6% | 22.2% | $64.75 | 20.0% | 0.0% | 5.3% | 18.4% | $3.48 | 22.4% | 0.9 | 31.0% | 15.6% | 30.0x | 6.5x | 3.52 |

|

| V | Contender | Visa Inc. | Financial Services | Credit Services | $355.28 | 0.75% | 0.74% | $0.670 | 4 | $2.680 | $0.590 | Nov 12, 2025 | Dec 1, 2025 | $299.00 | $375.51 | 15.6 | 13.5% | 15.7% | 14.9% | 17.2% | 13.1% | 20.7% | $254.75 | 39.0% | 0.0% | 11.3% | 50.1% | $13.68 | 52.1% | 1.1 | 35.0% | 36.1% | 34.9x | 18.3x | 2.74 |

|

| EPD | Champion | Enterprise Products Partners L. | Energy | Oil & Gas Midstream | $31.90 | 6.83% | 8.93% | $0.545 | 4 | $2.180 | $0.545 | Oct 31, 2025 | Nov 14, 2025 | $27.77 | $34.53 | 10.8 | 3.8% | 4.7% | 3.9% | 3.6% | 17.4% | 20.4% | $66.00 | -52.0% | 0.0% | 13.1% | 10.9% | $3.92 | 19.7% | 0.9 | 52.0% | 9.7% | 12.1x | 2.4x | 1.44 |

|

| QCOM | Contender | QUALCOMM Incorporated | Technology | Semiconductors | $173.76 | 2.05% | 2.25% | $0.890 | 4 | $3.560 | $0.890 | Dec 4, 2025 | Dec 18, 2025 | $120.80 | $205.95 | 8.5 | 5.1% | 6.3% | 6.5% | 6.6% | 15.3% | 20.0% | $25.10 | 592.0% | 0.0% | 13.3% | 12.6% | $13.08 | 23.3% | 2.8 | 41.0% | 13.9% | 34.6x | 8.8x | 13.42 |

|

| MO | King | Altria Group, Inc. | Consumer Defensive | Tobacco | $57.72 | 7.35% | 9.56% | $1.060 | 4 | $4.240 | $1.060 | Dec 26, 2025 | Jan 9, 2026 | $50.08 | $68.60 | 11.5 | 4.0% | 4.2% | 4.1% | 6.7% | 26.6% | 19.7% | $48.94 | 18.0% | 0.0% | -0.3% | 44.0% | $5.58 | — | 0.6 | 1.1% | 42.8% | 11.0x | —x | 3.95 |

|

| MA | Contender | Mastercard Incorporated | Financial Services | Credit Services | $580.24 | 0.52% | 0.57% | $0.760 | 4 | $3.040 | $0.760 | Jan 9, 2026 | Feb 9, 2026 | $465.59 | $601.77 | 14.2 | 15.2% | 15.8% | 13.7% | 16.9% | 10.2% | 19.5% | $391.25 | 48.0% | 0.0% | 12.2% | 45.3% | $19.61 | 184.9% | 1.1 | 71.0% | 55.3% | 37.1x | 66.1x | 2.30 |

|

| AMP | Contender | Ameriprise Financial, Inc. | Financial Services | Asset Management | $500.61 | 1.28% | 1.57% | $1.600 | 4 | $6.400 | $1.600 | Nov 10, 2025 | Nov 24, 2025 | $396.14 | $582.05 | 10.2 | 8.5% | 8.8% | 9.0% | 9.3% | -4.2% | 19.2% | $908.25 | -45.0% | 0.0% | 11.0% | 20.3% | $64.98 | 59.6% | 2.4 | 47.0% | 31.9% | 13.8x | 7.2x | 1.75 |

|

| GILD | Contender | Gilead Sciences, Inc. | Healthcare | Drug Manufacturers – General | $124.50 | 2.54% | 4.17% | $0.790 | 4 | $3.160 | $0.790 | Dec 15, 2025 | Dec 30, 2025 | $88.57 | $128.70 | 5.6 | 2.6% | 2.7% | 3.0% | 9.4% | 39.4% | 18.5% | $161.50 | -23.0% | 0.0% | 6.0% | 27.9% | $7.79 | 40.7% | 1.5 | 51.0% | 19.0% | 19.3x | 7.2x | 2.70 |

|

| ABBV | Contender | AbbVie Inc. | Healthcare | Drug Manufacturers – General | $231.55 | 2.83% | 4.30% | $1.640 | 4 | $6.560 | $1.640 | Jan 16, 2026 | Feb 17, 2026 | $164.39 | $244.81 | 9.6 | 5.8% | 5.2% | 6.8% | 12.5% | 38.4% | 17.8% | $32.75 | 607.0% | 0.0% | 3.7% | 4.0% | $11.80 | 138.0% | 0.7 | 1.0% | 3.8% | 176.8x | —x | 5.21 |

|

| PNC | Contender | PNC Financial Services Group, I | Financial Services | Banks – Regional | $212.68 | 3.20% | 3.91% | $1.700 | 4 | $6.800 | $1.700 | Oct 14, 2025 | Nov 5, 2025 | $145.12 | $214.59 | 10.7 | 4.8% | 4.7% | 7.5% | 12.6% | 17.7% | 16.2% | $387.25 | -45.0% | 0.0% | 0.3% | 27.3% | $13.84 | 11.5% | — | 51.0% | 5.2% | 13.7x | 1.6x | 1.19 |

|

| KR | Contender | Kroger Company (The) | Consumer Defensive | Grocery Stores | $63.16 | 2.22% | 2.23% | $0.350 | 4 | $1.400 | $0.350 | Nov 14, 2025 | Dec 1, 2025 | $58.12 | $74.90 | 16.7 | 9.8% | 12.5% | 14.5% | 13.0% | 5.6% | 15.6% | $28.25 | 124.0% | 0.0% | -1.9% | 0.5% | $9.58 | 8.0% | 0.9 | 76.0% | 2.5% | 55.9x | 5.1x | 5.35 |

|

| ENB | Champion | Enbridge Inc | Energy | Oil & Gas Midstream | $47.94 | 5.70% | 7.47% | $0.683 | 4 | $2.732 | $0.680 | Feb 17, 2026 | Mar 1, 2026 | $39.73 | $50.54 | 2.3 | -23.7% | -8.6% | -3.4% | 3.1% | 24.9% | 15.3% | $46.50 | 3.0% | 0.0% | 22.5% | 8.7% | $5.87 | 9.1% | 0.8 | 63.0% | 3.6% | 25.8x | 2.5x | 5.82 |

|

| WM | Contender | Waste Management, Inc. | Industrials | Waste Management | $222.58 | 1.48% | 1.62% | $0.825 | 4 | $3.300 | $0.825 | Dec 5, 2025 | Dec 19, 2025 | $194.11 | $242.58 | 10.1 | 10.0% | 8.3% | 8.6% | 7.9% | 12.4% | 14.2% | $158.75 | 40.0% | 0.0% | 8.0% | 10.4% | $14.54 | 29.3% | 0.8 | 70.0% | 8.1% | 35.1x | 9.4x | 3.09 |

|

| USB | Contender | U.S. Bancorp | Financial Services | Banks – Regional | $54.71 | 2.85% | 4.48% | $0.520 | 3 | $1.560 | $0.500 | Dec 31, 2025 | Jan 15, 2026 | $35.18 | $55.15 | 12.8 | 36.5% | -4.8% | 9.9% | 7.2% | 22.3% | 14.2% | $109.25 | -50.0% | 0.0% | -2.4% | 24.1% | $6.37 | 11.7% | — | 53.0% | 5.9% | 12.5x | 1.5x | 1.62 |

|

| CSL | Champion | Carlisle Companies Incorporated | Industrials | Building Products & Equipment | $328.23 | 1.34% | 1.10% | $1.100 | 4 | $4.400 | $1.100 | Nov 14, 2025 | Dec 1, 2025 | $293.43 | $435.92 | 16.8 | 13.5% | 17.6% | 15.4% | 14.3% | -9.6% | 13.1% | $438.50 | -25.0% | 0.0% | 9.1% | 15.5% | $27.38 | 32.5% | 3.3 | 59.0% | 17.9% | 18.7x | 6.9x | 2.13 |

|

| AMGN | Contender | Amgen Inc. | Healthcare | Drug Manufacturers – General | $332.22 | 2.87% | 3.39% | $2.380 | 4 | $9.520 | $2.380 | Feb 13, 2026 | Mar 6, 2026 | $257.05 | $346.38 | 11.1 | 5.8% | 7.1% | 8.3% | 11.7% | 34.3% | 12.6% | $323.00 | 3.0% | 0.0% | 18.6% | 19.5% | $24.38 | 81.7% | 1.3 | 84.0% | 11.4% | 25.7x | 18.6x | 7.96 |

|

| PSX | Contender | Phillips 66 | Energy | Oil & Gas Refining & Marketing | $128.22 | 3.74% | 4.32% | $1.200 | 4 | $4.800 | $1.200 | Nov 17, 2025 | Dec 1, 2025 | $91.01 | $144.96 | 9.4 | 5.6% | 7.4% | 5.7% | 8.1% | 22.5% | 12.5% | $92.50 | 39.0% | 0.0% | -2.9% | 1.1% | $8.46 | 5.6% | 1.2 | 42.0% | 3.3% | 34.7x | 1.9x | 0.43 |

|

| AEP | Contender | American Electric Power Company | Utilities | Utilities – Regulated Electric | $116.60 | 3.26% | 3.99% | $0.950 | 4 | $3.800 | $0.930 | Nov 10, 2025 | Dec 10, 2025 | $89.91 | $124.80 | 8.9 | 4.8% | 5.7% | 5.7% | 5.7% | 34.6% | 12.0% | $170.50 | -32.0% | 0.0% | 2.4% | 17.2% | $12.84 | 12.9% | 0.7 | 60.0% | 5.2% | 17.1x | 2.1x | 2.49 |

|

| SO | Contender | Southern Company (The) | Utilities | Utilities – Regulated Electric | $87.96 | 3.37% | 4.13% | $0.740 | 4 | $2.960 | $0.740 | Nov 17, 2025 | Dec 8, 2025 | $80.46 | $100.84 | 6.3 | 2.8% | 2.9% | 3.0% | 3.2% | 13.0% | 12.0% | $100.50 | -12.0% | 0.0% | 5.8% | 15.4% | $8.52 | 11.4% | 0.8 | 65.0% | 4.6% | 21.9x | 2.8x | 3.25 |

|

| MDT | Champion | Medtronic plc. | Healthcare | Medical Devices | $96.64 | 2.94% | 3.04% | $0.710 | 4 | $2.840 | $0.710 | Dec 26, 2025 | Jan 16, 2026 | $79.29 | $106.33 | 1.5 | -24.0% | -7.4% | -1.4% | 1.9% | 25.3% | 11.6% | $92.25 | 5.0% | 0.0% | 3.6% | 13.7% | $5.55 | 9.8% | 2.4 | 36.0% | 6.4% | 26.2x | 2.6x | 3.19 |

|

| PRU | Contender | Prudential Financial, Inc. | Financial Services | Insurance – Life | $113.23 | 4.77% | 5.42% | $1.350 | 4 | $5.400 | $1.350 | Nov 18, 2025 | Dec 11, 2025 | $90.38 | $123.88 | 9.0 | 3.8% | 4.0% | 4.2% | 8.3% | 4.8% | 11.3% | $182.75 | -38.0% | 0.0% | 33.7% | 4.7% | $15.07 | 8.5% | 0.8 | 39.0% | 5.2% | 15.5x | 1.2x | 5.38 |

|

| CNQ | Contender | Canadian Natural Resources Limi | Energy | Oil & Gas E&P | $33.24 | 5.20% | 5.09% | $0.432 | 4 | $1.728 | $0.410 | Dec 12, 2025 | Jan 6, 2026 | $24.65 | $35.12 | 11.5 | -45.6% | -21.7% | 6.3% | 9.4% | 16.0% | 11.3% | $57.75 | -42.0% | 0.0% | -0.9% | 17.2% | $7.09 | 16.6% | 0.9 | 29.0% | 11.8% | 14.4x | 2.3x | — |

|

| VZ | Contender | Verizon Communications Inc. | Communication Services | Telecom Services | $40.65 | 6.79% | 6.97% | $0.690 | 4 | $2.760 | $0.678 | Jan 12, 2026 | Feb 2, 2026 | $37.59 | $47.36 | 8.7 | 1.9% | 1.9% | 2.0% | 2.1% | 16.1% | 10.6% | $117.25 | -65.0% | 0.0% | 0.6% | 14.4% | $9.12 | 19.9% | 0.7 | 58.0% | 8.1% | 8.7x | 1.6x | 3.63 |

|

| STAG | Contender | Stag Industrial, Inc. | Real Estate | REIT – Industrial | $37.29 | 3.66% | 4.40% | $0.124 | 11 | $1.364 | $0.124 | Dec 31, 2025 | Jan 15, 2026 | $28.61 | $39.73 | 6.1 | 9.9% | -2.1% | 2.4% | 0.8% | 19.4% | 9.9% | $32.50 | 15.0% | 0.0% | 8.4% | 29.2% | $2.48 | 7.2% | 1.3 | 47.0% | 3.8% | 28.7x | 2.0x | — |

|

| DUK | Contender | Duke Energy Corporation (Holdin | Utilities | Utilities – Regulated Electric | $117.93 | 3.61% | 4.31% | $1.065 | 4 | $4.260 | $1.065 | Nov 14, 2025 | Dec 16, 2025 | $105.20 | $130.03 | 5.6 | 1.9% | 2.0% | 2.0% | 2.7% | 16.8% | 9.8% | $158.75 | -26.0% | 0.0% | 4.5% | 15.6% | $15.49 | 9.9% | 0.6 | 61.0% | 3.8% | 18.6x | 1.8x | 3.04 |

|

| ASB | Contender | Associated Banc-Corp | Financial Services | Banks – Regional | $26.18 | 3.67% | 4.29% | $0.240 | 4 | $0.960 | $0.230 | Dec 1, 2025 | Dec 15, 2025 | $18.32 | $27.58 | 8.9 | 4.5% | 4.7% | 5.3% | 8.5% | 17.0% | 9.8% | $4.30 | 509.0% | 0.0% | -5.9% | 14.1% | $3.64 | 3.8% | — | 18.0% | 2.9% | 30.4x | 0.9x | 6.32 |

|

| JNJ | King | Johnson & Johnson | Healthcare | Drug Manufacturers – General | $209.04 | 2.49% | 3.04% | $1.300 | 4 | $5.200 | $1.300 | Nov 25, 2025 | Dec 9, 2025 | $140.68 | $215.19 | 7.7 | 4.7% | 4.9% | 5.2% | 5.7% | 52.2% | 9.7% | $258.50 | -19.0% | 0.0% | 4.3% | 27.3% | $10.05 | 33.6% | 1.1 | 33.0% | 22.1% | 20.2x | 6.3x | 3.26 |

|

| PLD | Contender | Prologis, Inc. | Real Estate | REIT – Industrial | $129.38 | 3.12% | 2.99% | $1.010 | 4 | $4.040 | $1.010 | Dec 16, 2025 | Dec 31, 2025 | $85.35 | $131.70 | 14.9 | 5.2% | 8.5% | 11.7% | 10.3% | 31.3% | 8.8% | $17.20 | 652.0% | 0.0% | 10.2% | 40.0% | $5.58 | 6.0% | 0.8 | 40.0% | 3.7% | 37.6x | 2.3x | 4.04 |

|

| MCD | King | McDonald's Corporation | Consumer Cyclical | Restaurants | $309.80 | 2.40% | 2.42% | $1.860 | 4 | $7.440 | $1.770 | Dec 1, 2025 | Dec 15, 2025 | $276.53 | $326.32 | 9.7 | 5.8% | 8.2% | 7.3% | 7.6% | 10.5% | 8.5% | $292.75 | 6.0% | 0.0% | 1.7% | 32.0% | $14.72 | — | 1.0 | 1.0% | 16.9% | 26.5x | —x | 2.92 |

|

| FANG | Challenger | Diamondback Energy, Inc. | Energy | Oil & Gas E&P | $148.65 | 2.69% | 4.71% | $1.000 | 4 | $4.000 | $1.000 | Nov 13, 2025 | Nov 20, 2025 | $114.00 | $180.91 | 24.4 | -51.7% | -23.6% | 21.7% | — | -0.9% | 8.3% | $356.00 | -58.0% | 0.0% | 31.6% | 27.3% | $30.56 | 10.9% | 0.6 | 29.0% | 8.0% | 10.4x | 1.1x | — |

|

| XOM | Champion | Exxon Mobil Corporation | Energy | Oil & Gas Integrated | $120.71 | 3.41% | 4.44% | $1.030 | 4 | $4.120 | $0.990 | Nov 14, 2025 | Dec 10, 2025 | $97.80 | $120.81 | 6.2 | 4.2% | 4.1% | 2.8% | 3.3% | 21.4% | 8.2% | $172.00 | -30.0% | 0.0% | 1.5% | 9.0% | $12.22 | 11.4% | 1.1 | 11.0% | 10.1% | 17.6x | 2.0x | 5.93 |

|

| CSX | Contender | CSX Corporation | Industrials | Railroads | $36.69 | 1.42% | 1.38% | $0.130 | 4 | $0.520 | $0.130 | Nov 28, 2025 | Dec 15, 2025 | $26.22 | $37.54 | 9.9 | 8.3% | 9.1% | 8.4% | 8.3% | 16.5% | 7.6% | $38.50 | -5.0% | 0.0% | -0.8% | 20.6% | $2.48 | 22.6% | 0.9 | 60.0% | 9.3% | 23.8x | 5.4x | 1.59 |

|

| KO | King | Coca-Cola Company (The) | Consumer Defensive | Beverages – Non-Alcoholic | $70.28 | 2.90% | 3.24% | $0.510 | 4 | $2.040 | $0.510 | Dec 1, 2025 | Dec 15, 2025 | $60.62 | $74.38 | 7.4 | 5.2% | 5.0% | 4.5% | 4.4% | 19.2% | 7.4% | $75.50 | -7.0% | 0.0% | 2.4% | 27.4% | $1.77 | 42.4% | 1.2 | 58.0% | 18.3% | 23.3x | 9.7x | 2.99 |

|

| UNP | Contender | Union Pacific Corporation | Industrials | Railroads | $234.02 | 2.36% | 2.34% | $1.380 | 4 | $5.520 | $1.380 | Dec 5, 2025 | Dec 30, 2025 | $204.66 | $256.84 | 9.4 | 3.0% | 2.3% | 7.0% | 9.5% | 6.6% | 7.1% | $294.75 | -21.0% | 0.0% | 0.5% | 28.7% | $16.40 | 41.6% | 0.8 | 64.0% | 14.8% | 19.9x | 8.0x | 2.56 |

|

| ABT | Contender | Abbott Laboratories | Healthcare | Medical Devices | $125.39 | 1.88% | 1.89% | $0.590 | 4 | $2.360 | $0.590 | Jan 15, 2026 | Feb 13, 2026 | $110.86 | $141.23 | 12.3 | 7.3% | 7.9% | 10.4% | 9.4% | 13.2% | 7.1% | $39.80 | 215.0% | 0.0% | 4.6% | 31.9% | $5.24 | 30.6% | 1.7 | 19.0% | 22.5% | 15.8x | 4.3x | 1.62 |

|

| ADC | Challenger | Agree Realty Corporation | Real Estate | REIT – Retail | $72.57 | 3.97% | 4.59% | $0.262 | 11 | $2.882 | $0.262 | Dec 31, 2025 | Jan 15, 2026 | $67.58 | $79.65 | 9.0 | 11.8% | 0.4% | 5.0% | 5.2% | 12.2% | 6.5% | $42.75 | 70.0% | 0.0% | 14.8% | 27.0% | $4.21 | 3.5% | 1.0 | 38.0% | 2.2% | 42.4x | 1.5x | 6.05 |

|

| TXN | Contender | Texas Instruments Incorporated | Technology | Semiconductors | $176.05 | 3.23% | 3.03% | $1.420 | 4 | $5.680 | $1.360 | Oct 31, 2025 | Nov 12, 2025 | $139.95 | $221.69 | 11.4 | 4.6% | 5.5% | 8.1% | 14.7% | -2.0% | 6.4% | $137.00 | 29.0% | 0.0% | -10.7% | 29.2% | $7.59 | 29.8% | 4.5 | 45.0% | 16.9% | 32.1x | 9.6x | 2.99 |

|

| HD | Contender | Home Depot, Inc. (The) | Consumer Cyclical | Home Improvement Retail | $347.91 | 2.64% | 2.57% | $2.300 | 4 | $9.200 | $2.300 | Dec 4, 2025 | Dec 18, 2025 | $326.31 | $426.75 | 11.6 | 2.2% | 6.6% | 8.9% | 14.6% | -6.8% | 6.4% | $366.50 | -5.0% | 0.0% | 4.5% | 8.8% | $17.73 | 162.9% | 1.1 | 82.0% | 22.7% | 23.7x | 28.6x | 5.96 |

|

| FRT | King | Federal Realty Investment Trust | Real Estate | REIT – Retail | $102.44 | 3.31% | 4.36% | $1.130 | 3 | $3.390 | $1.100 | Jan 2, 2026 | Jan 15, 2026 | $80.65 | $112.29 | 4.3 | 35.1% | 1.1% | 1.0% | 2.2% | 0.2% | 6.0% | $98.50 | 4.0% | 0.0% | 6.2% | 27.0% | $6.92 | 10.5% | 0.4 | 61.0% | 4.4% | 26.0x | 2.9x | — |

|

| ADP | King | Automatic Data Processing, Inc. | Technology | Software – Application | $260.35 | 2.61% | 2.18% | $1.700 | 4 | $6.800 | $1.540 | Dec 12, 2025 | Jan 1, 2026 | $247.18 | $329.93 | 14.2 | 10.1% | 13.1% | 11.5% | 12.2% | -8.0% | 5.8% | $253.00 | 3.0% | 0.0% | 7.1% | 19.8% | $11.76 | 70.6% | 1.1 | 40.0% | 42.8% | 25.7x | 16.5x | 2.72 |

|

| SWK | King | Stanley Black & Decker, Inc. | Industrials | Tools & Accessories | $75.00 | 4.43% | 3.53% | $0.830 | 4 | $3.320 | $0.830 | Dec 1, 2025 | Dec 16, 2025 | $53.91 | $91.06 | 7.9 | 1.2% | 1.2% | 3.5% | 4.4% | 1.7% | 5.1% | $14.50 | 417.0% | 0.0% | -2.6% | 2.9% | $4.48 | 4.9% | 1.1 | 34.0% | 3.2% | 25.9x | 1.3x | 0.96 |

|

| TROW | Champion | T. Rowe Price Group, Inc. | Financial Services | Asset Management | $104.78 | 4.85% | 4.87% | $1.270 | 4 | $5.080 | $1.270 | Dec 15, 2025 | Dec 30, 2025 | $77.85 | $118.32 | 12.0 | 2.4% | 1.9% | 7.1% | 2.2% | 0.0% | 4.3% | $229.25 | -54.0% | 0.0% | 9.8% | 27.9% | $6.83 | 18.7% | 3.8 | 4.0% | 18.6% | 11.4x | 2.1x | 1.92 |

|

| INFY | Challenger | Infosys Limited | Technology | Information Technology Services | $18.36 | 2.82% | 2.69% | $0.259 | 2 | $0.518 | $0.257 | Oct 27, 2025 | Nov 12, 2025 | $15.82 | $30.00 | 15.0 | -11.8% | 7.9% | 12.1% | 10.3% | -13.5% | 4.1% | $19.75 | -7.0% | 0.0% | 6.1% | 16.6% | $1.10 | 29.0% | 2.3 | 5.0% | 2,397.4% | 23.3x | 6.5x | 3.57 |

|

| LMT | Contender | Lockheed Martin Corporation | Industrials | Aerospace & Defense | $486.10 | 2.84% | 2.94% | $3.450 | 4 | $13.800 | $3.300 | Dec 1, 2025 | Dec 30, 2025 | $410.11 | $516.00 | 9.2 | 4.7% | 5.4% | 6.4% | 8.1% | 5.2% | 3.6% | $449.25 | 8.0% | 0.0% | 5.1% | 5.7% | $27.49 | 62.8% | 1.1 | 77.0% | 16.5% | 27.0x | 18.1x | 0.86 |

|

| O | Champion | Realty Income Corporation | Real Estate | REIT – Retail | $56.93 | 5.22% | 5.59% | $0.270 | 11 | $2.970 | $0.270 | Dec 31, 2025 | Jan 15, 2026 | $50.71 | $61.09 | 8.7 | 12.1% | 2.7% | 3.5% | 3.9% | 20.9% | 3.5% | $26.75 | 113.0% | 0.0% | 27.4% | 18.1% | $4.09 | 2.5% | 1.4 | 41.0% | 1.5% | 53.2x | 1.3x | 2.87 |

|

| MRK | Contender | Merck & Company, Inc. | Healthcare | Drug Manufacturers – General | $107.31 | 3.17% | 3.41% | $0.850 | 4 | $3.400 | $0.810 | Dec 15, 2025 | Jan 8, 2026 | $73.31 | $107.59 | 9.9 | 5.1% | 5.4% | 6.7% | 6.6% | 15.1% | 3.0% | $189.00 | -43.0% | 0.0% | 6.7% | 29.6% | $6.88 | 39.5% | 1.7 | 44.0% | 22.6% | 14.2x | 5.2x | — |

|

| BEN | Champion | Franklin Resources, Inc. | Financial Services | Asset Management | $24.07 | 6.65% | 5.06% | $0.320 | 5 | $1.600 | $0.320 | Dec 30, 2025 | Jan 9, 2026 | $16.25 | $26.08 | 16.2 | 3.2% | -4.3% | 9.6% | 7.3% | 30.2% | 3.0% | $22.75 | 6.0% | 0.0% | 3.5% | 6.0% | $2.04 | 3.8% | 4.1 | 52.0% | 2.1% | 26.5x | 1.0x | 2.28 |

|

| VICI | Challenger | VICI Properties Inc. | Real Estate | REIT – Diversified | $28.26 | 6.37% | 5.95% | $0.450 | 4 | $1.800 | $0.450 | Dec 17, 2025 | Jan 8, 2026 | $27.56 | $34.03 | 13.4 | 4.1% | 5.6% | 7.1% | — | 9.8% | 3.0% | $65.75 | -57.0% | 0.0% | 6.6% | 70.2% | $2.30 | 10.4% | 37.1 | 39.0% | 6.2% | 10.8x | 1.1x | 3.50 |

|

| NEE | Champion | NextEra Energy, Inc. | Utilities | Utilities – Regulated Electric | $81.06 | 2.80% | 2.70% | $0.567 | 4 | $2.268 | $0.567 | Nov 21, 2025 | Dec 15, 2025 | $61.72 | $87.53 | 12.9 | 10.1% | 10.1% | 10.1% | 11.4% | 19.2% | 2.6% | $78.75 | 3.0% | 0.0% | -12.0% | 24.7% | $5.75 | 8.2% | 0.6 | 61.0% | 5.0% | 25.7x | 3.1x | 3.03 |

|

| NNN | Champion | NNN REIT, Inc. | Real Estate | REIT – Retail | $39.58 | 6.06% | 5.90% | $0.600 | 4 | $2.400 | $0.600 | Oct 31, 2025 | Nov 14, 2025 | $35.80 | $44.23 | 8.7 | 3.1% | 3.0% | 2.7% | 3.3% | 9.7% | 2.6% | $52.00 | -24.0% | 0.0% | 5.0% | 43.2% | $3.47 | 8.9% | 0.5 | 52.0% | 4.4% | 19.0x | 1.7x | 8.27 |

|

| ACN | Contender | Accenture plc | Technology | Information Technology Services | $272.18 | 2.18% | 1.48% | $1.480 | 4 | $5.920 | $1.480 | Jan 13, 2026 | Feb 13, 2026 | $229.40 | $398.35 | 8.4 | -17.0% | 3.3% | 6.2% | 7.7% | -21.2% | 2.6% | $302.25 | -10.0% | 0.0% | 7.4% | 10.8% | $19.69 | 25.0% | 1.4 | 19.0% | 20.2% | 22.5x | 5.4x | 3.02 |

|

| PG | King | Procter & Gamble Company (The) | Consumer Defensive | Household & Personal Products | $144.76 | 2.92% | 2.67% | $1.057 | 4 | $4.228 | $1.057 | Oct 24, 2025 | Nov 17, 2025 | $138.14 | $179.99 | 8.9 | 5.5% | 5.0% | 6.0% | 4.7% | -9.8% | 1.7% | $171.25 | -15.0% | 0.0% | 0.3% | 19.7% | $8.10 | 31.9% | 0.7 | 32.0% | 22.0% | 21.1x | 6.4x | 4.23 |

|

| CVX | Champion | Chevron Corporation | Energy | Oil & Gas Integrated | $151.18 | 4.52% | 4.72% | $1.710 | 4 | $6.840 | $1.710 | Nov 18, 2025 | Dec 10, 2025 | $132.04 | $168.96 | 10.3 | 4.9% | 6.4% | 5.8% | 4.8% | 14.8% | 0.2% | $165.92 | -9.0% | 0.0% | 0.9% | 6.6% | $15.93 | 7.3% | 1.2 | 17.0% | 6.9% | 21.3x | 1.6x | 7.38 |

|

| HPQ | Contender | HP Inc. | Technology | Computer Hardware | $23.10 | 5.19% | 3.70% | $0.300 | 4 | $1.200 | $0.289 | Dec 11, 2025 | Jan 2, 2026 | $21.21 | $35.28 | 15.3 | 4.5% | 4.8% | 10.1% | 12.6% | -23.9% | 0.1% | $66.25 | -65.0% | 0.0% | 3.2% | 4.6% | $4.03 | — | 0.8 | 1.0% | 29.2% | 8.7x | —x | 2.21 |

|

| CMCSA | Contender | Comcast Corporation | Communication Services | Telecom Services | $29.69 | 4.45% | 2.96% | $0.330 | 4 | $1.320 | $0.330 | Jan 14, 2026 | Feb 4, 2026 | $25.75 | $38.40 | 12.1 | 6.6% | 7.0% | 7.6% | 10.3% | -15.2% | -0.9% | $150.50 | -80.0% | 0.0% | 1.8% | 18.3% | $9.05 | 24.2% | 0.9 | 49.0% | 12.2% | 4.9x | 1.1x | — |

|

| SBUX | Contender | Starbucks Corporation | Consumer Cyclical | Restaurants | $86.20 | 2.88% | 2.37% | $0.620 | 4 | $2.480 | $0.610 | Feb 13, 2026 | Feb 27, 2026 | $75.50 | $117.46 | 10.7 | 5.6% | 7.0% | 7.8% | 13.7% | -1.4% | -1.5% | $8.15 | 958.0% | 0.0% | 2.8% | 5.0% | $4.18 | — | 0.7 | 1.5% | 12.0% | 52.9x | —x | 2.00 |

|

| AMT | Contender | American Tower Corporation (REI | Real Estate | REIT – Specialty | $176.45 | 3.85% | 2.92% | $1.700 | 4 | $6.800 | $1.700 | Dec 29, 2025 | Feb 2, 2026 | $170.77 | $234.33 | 6.3 | -21.3% | -4.5% | 2.4% | 10.9% | 2.3% | -2.7% | $156.50 | 13.0% | 0.0% | -9.1% | 28.1% | $11.18 | 28.8% | 0.6 | 91.0% | 6.6% | 28.2x | 20.9x | 0.78 |

|

| PEP | King | Pepsico, Inc. | Consumer Defensive | Beverages – Non-Alcoholic | $144.92 | 3.93% | 3.31% | $1.423 | 4 | $5.692 | $1.423 | Dec 5, 2025 | Jan 6, 2026 | $127.60 | $160.15 | 10.9 | 5.5% | 7.5% | 6.9% | 7.4% | 2.4% | -3.0% | $131.50 | 10.0% | 0.0% | 0.4% | 7.8% | $8.60 | 37.2% | 0.9 | 69.0% | 12.3% | 27.6x | 10.2x | 4.94 |

|

| MDLZ | Contender | Mondelez International, Inc. | Consumer Defensive | Confectioners | $54.97 | 2.73% | 2.47% | $0.500 | 3 | $1.500 | $0.470 | Dec 31, 2025 | Jan 14, 2026 | $53.13 | $71.15 | 19.4 | 44.7% | 1.6% | 16.6% | 11.6% | -2.7% | -3.0% | $13.35 | 312.0% | 0.0% | 1.2% | 9.8% | $2.77 | 13.1% | 0.6 | 40.0% | 8.4% | 20.6x | 2.7x | 2.36 |

|

| COP | Challenger | ConocoPhillips | Energy | Oil & Gas E&P | $92.13 | 3.65% | 3.86% | $0.840 | 4 | $3.360 | $0.780 | Nov 17, 2025 | Dec 1, 2025 | $79.88 | $106.20 | 17.1 | 1.9% | -15.1% | 13.5% | 0.8% | 1.7% | -3.3% | $177.00 | -48.0% | 0.0% | -2.8% | 14.3% | $16.13 | 15.4% | 1.3 | 26.0% | 10.0% | 13.0x | 1.8x | — |

|

| BMY | Contender | Bristol-Myers Squibb Company | Healthcare | Drug Manufacturers – General | $54.43 | 4.56% | 4.07% | $0.620 | 4 | $2.480 | $0.620 | Jan 2, 2026 | Feb 2, 2026 | $42.52 | $63.33 | 11.2 | 3.3% | 4.7% | 6.6% | 5.3% | 3.6% | -3.4% | $74.25 | -27.0% | 0.0% | 7.3% | 12.6% | $8.16 | 33.8% | 1.3 | 71.0% | 9.3% | 18.3x | 6.0x | — |

|

| HSY | Contender | The Hershey Company | Consumer Defensive | Confectioners | $182.82 | 3.00% | 2.51% | $1.370 | 4 | $5.480 | $1.370 | Nov 17, 2025 | Dec 15, 2025 | $140.13 | $199.00 | 14.7 | 0.0% | 12.3% | 11.7% | 9.4% | 13.2% | -4.3% | $33.45 | 447.0% | 0.0% | 0.3% | 11.8% | $15.47 | 31.0% | 1.4 | 52.0% | 14.3% | 27.3x | 8.1x | 1.77 |

|

| KMB | King | Kimberly-Clark Corporation | Consumer Defensive | Household & Personal Products | $101.35 | 4.97% | 4.00% | $1.260 | 4 | $5.040 | $1.260 | Dec 5, 2025 | Jan 5, 2026 | $99.22 | $150.45 | 8.3 | 3.3% | 2.8% | 3.3% | 3.7% | -16.0% | -4.6% | $73.33 | 38.0% | 0.0% | -1.8% | 10.9% | $7.90 | 136.9% | 0.8 | 83.0% | 25.5% | 17.2x | 25.3x | 7.12 |

|

| IEX | Contender | IDEX Corporation | Industrials | Specialty Industrial Machinery | $179.80 | 1.58% | 1.26% | $0.710 | 4 | $2.840 | $0.710 | Jan 16, 2026 | Jan 30, 2026 | $153.36 | $226.05 | 8.7 | 4.1% | 6.4% | 7.1% | 8.6% | -12.2% | -6.2% | $157.75 | 14.0% | 0.0% | -0.2% | 14.0% | $8.60 | 12.2% | 2.9 | 32.0% | 8.3% | 28.5x | 3.4x | 5.20 |

|

| TGT | King | Target Corporation | Consumer Defensive | Discount Stores | $99.13 | 4.60% | 2.96% | $1.140 | 4 | $4.560 | $1.140 | Nov 12, 2025 | Dec 1, 2025 | $83.44 | $145.08 | 15.6 | 1.8% | 4.5% | 11.0% | 7.7% | -20.1% | -8.1% | $206.25 | -52.0% | 0.0% | -0.8% | 3.6% | $14.96 | 25.1% | 1.0 | 55.0% | 11.2% | 12.0x | 2.9x | 2.37 |

|

| IIPR | Challenger | Innovative Industrial Propertie | Real Estate | REIT – Industrial | $50.45 | 11.30% | 8.27% | $1.900 | 3 | $5.700 | $1.900 | Dec 31, 2025 | Jan 15, 2026 | $44.58 | $75.71 | 30.0 | 35.2% | -4.0% | 18.7% | — | -3.2% | -9.4% | $32.51 | 55.0% | 0.0% | -0.3% | 44.6% | $7.35 | 6.6% | 0.2 | 14.0% | 5.7% | 11.9x | 0.8x | 1.39 |

|

| LYB | Contender | LyondellBasell Industries NV | Basic Materials | Specialty Chemicals | $43.33 | 12.65% | 8.26% | $1.370 | 4 | $5.480 | $1.370 | Dec 1, 2025 | Dec 8, 2025 | $41.58 | $79.39 | 18.0 | 3.4% | -18.0% | 5.3% | 9.2% | -27.7% | -10.3% | $67.75 | -36.0% | 0.0% | -2.0% | -3.7% | $8.30 | -10.6% | 1.6 | 53.0% | -5.0% | —x | 1.3x | — |

|

| ADM | King | Archer-Daniels-Midland Company | Consumer Defensive | Farm Products | $57.78 | 3.53% | 2.97% | $0.510 | 4 | $2.040 | $0.510 | Nov 19, 2025 | Dec 11, 2025 | $40.98 | $65.00 | 10.7 | 2.0% | 8.4% | 7.2% | 6.2% | 22.9% | -10.9% | $15.56 | 271.0% | 0.0% | -9.0% | 1.4% | $12.67 | 5.2% | 1.4 | 25.0% | 3.9% | 23.5x | 1.2x | 0.97 |

| UPS | Contender | United Parcel Service, Inc. | Industrials | Integrated Freight & Logistics | $99.88 | 6.57% | 4.53% | $1.640 | 4 | $6.560 | $1.640 | Nov 17, 2025 | Dec 4, 2025 | $82.00 | $136.99 | 16.7 | 0.6% | 2.6% | 10.2% | 8.4% | -9.8% | -11.0% | $103.40 | -3.0% | 0.0% | 0.1% | 6.2% | $11.45 | 33.6% | 1.3 | 64.0% | 13.4% | 15.4x | 5.4x | 3.86 |

|

| DVN | Challenger | Devon Energy Corporation | Energy | Oil & Gas E&P | $36.34 | 2.64% | 6.00% | $0.240 | 4 | $0.960 | $0.240 | Dec 15, 2025 | Dec 30, 2025 | $25.89 | $38.88 | 9.8 | -33.8% | -42.9% | 7.1% | 0.0% | 22.9% | -11.6% | $106.00 | -66.0% | 0.0% | 4.5% | 15.6% | $10.91 | 18.6% | 1.0 | 33.0% | 11.7% | 8.6x | 1.5x | 2.93 |

|

| UNH | Contender | UnitedHealth Group Incorporated | Healthcare | Healthcare Plans | $330.67 | 2.67% | 1.69% | $2.210 | 4 | $8.840 | $2.210 | Dec 8, 2025 | Dec 16, 2025 | $234.60 | $606.36 | 15.2 | 6.7% | 10.9% | 12.6% | 16.6% | -31.8% | -12.2% | $95.90 | 245.0% | 0.0% | 7.7% | 4.0% | $23.14 | 17.5% | 0.8 | 43.0% | 10.5% | 17.2x | 3.1x | 1.96 |

|

| GIS | Challenger | General Mills, Inc. | Consumer Defensive | Packaged Foods | $47.14 | 5.18% | 3.75% | $0.610 | 4 | $2.440 | $0.610 | Jan 9, 2026 | Feb 2, 2026 | $45.15 | $67.35 | 9.3 | 1.7% | 4.8% | 4.1% | 3.4% | -19.0% | -13.1% | $116.25 | -59.0% | 0.0% | -1.9% | 13.5% | $4.42 | 27.2% | 0.7 | 57.0% | 11.7% | 10.1x | 2.7x | 5.15 |

|

| PFE | Contender | Pfizer, Inc. | Healthcare | Drug Manufacturers – General | $25.14 | 6.84% | 5.51% | $0.430 | 4 | $1.720 | $0.430 | Jan 23, 2026 | Mar 6, 2026 | $20.92 | $27.69 | 10.4 | 2.4% | 2.4% | 3.6% | 4.9% | 8.2% | -14.6% | $43.00 | -42.0% | 0.0% | 8.8% | 15.7% | $2.30 | 10.6% | 1.3 | 38.0% | 6.7% | 14.6x | 1.5x | — |

|

| AES | Contender | The AES Corporation | Utilities | Utilities – Diversified | $14.08 | 5.00% | 3.96% | $0.176 | 4 | $0.704 | $0.176 | Jan 30, 2026 | Feb 13, 2026 | $9.46 | $15.51 | 9.2 | 1.7% | 3.7% | 4.2% | 5.8% | 23.1% | -16.3% | $7.60 | 85.0% | 0.0% | -3.1% | 10.3% | $5.49 | 5.1% | 0.7 | 87.0% | 4.2% | 9.3x | 2.6x | 1.27 |

|

| NKE | Contender | Nike, Inc. | Consumer Cyclical | Footwear & Accessories | $61.11 | 2.68% | 1.46% | $0.410 | 4 | $1.640 | $0.400 | Dec 1, 2025 | Jan 2, 2026 | $52.28 | $82.44 | 12.5 | 6.6% | 8.7% | 9.8% | 10.7% | -16.0% | -17.4% | $8.55 | 615.0% | 0.0% | -9.8% | 5.4% | $0.00 | 18.0% | 2.1 | — | 10.4% | 35.7x | 6.4x | 0.70 |

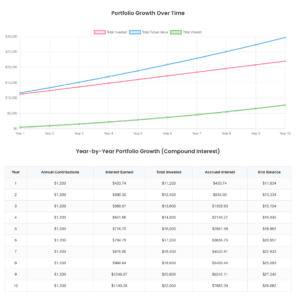

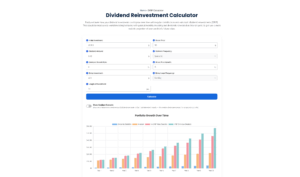

Calculators

Dividend ETF Calculators

Get started with DRIP investing using our calculators. Fill in the information, and it will show you dividend returns.

For beginners

Getting started

Starting with DRIP investing is simple. It’s about making small, regular investments grow over time, just like how Coca-Cola started. Here, we’ll explain the easy steps from your first dividend to picking a DRIP plan that fits you. Let’s get those dividends to build up your savings.

Participating in the DRIP

Generally, there are three ways investors can participate in dividend reinvestment plans: company-run plans, transfer agent plans, and brokerage plans

Company run plans

Many companies run these programs through their investor relations or shareholder services departments. Several companies have even started to offer Individual Retirement Accounts in addition to their reinvestment plans.

Companies may have participation rules that include owning at least one share prior to joining the dividend reinvestment plan. They may also require the stock to be in the investor’s name rather than street name.

A phone call to the shareholder services department is an effective way to learn about company-specific participation rules.

Transfer agent plans

Due to the overwhelming popularity of some DRIPs, companies may engage the help of transfer agents to administer their programs. The transfer agent is a third-party broker that typically runs plans for many different companies.

Since the transfer agent is running multiple programs using the same resources, they can do it more cost-effectively than some of the issuing companies.

Some of the larger transfer agents include American Stock Transfer & Trust Company, Mellon Investor Services, and ComputerShare.

Brokerage plans

While dividend reinvestment programs reduce the fees collected by traditional brokerage houses, many of these firms now attempt to mirror DRIPs by offering the ability to reinvest dividends without charging a fee.

Unfortunately, these plans usually lack the most attractive feature of a real DRIP: The cash purchase of new shares of stock without fees.

More on DRIP brokersStrategies

Dividend investing strategies

Learn about Dividend Investing Strategies in a way that’s easy to understand. This section will show you how to pick good stocks that pay dividends and make a plan to earn regular income from them. Get ready to grow your money smarter.

dividend champions

Future dividend champions

Meet the Future Dividend Champions. These companies are on track to becoming top picks for investors who love getting regular dividend payments. In this section, we’ll show you why these stocks stand out and how they could help give your investments a boost over time. Start exploring which one might be the champion for your portfolio.

3000+

Downloads

20+

Years in drip investing

stay updated

Dividend champions spreadsheet

Dividend champions are companies that have consistently raised their dividends each year for multiple years in a row.

Use our Dividend Champions spreadsheet for the latest list of dividend champions, contenders, and challengers.

Updated monthly on the 1st.

Download nowresources & tools

Resources for the dividend investor

Fill your investor’s toolbox with our handpicked list of easy-to-read books. If you’re just starting or already know a lot about investing, these books are full of tips and advice to help you make money with dividends. Check out our favorites and learn new ways to improve your investments.

For experts

Deep dive into drip investing

Dive into the world of dividend reinvestment. Find out how to pick stocks that can grow your money and learn easy ways to save on taxes. These articles will help you understand how to make smart choices for building your investments over time.

as seen on

DripInvesting on the web

“THANK YOU SO MUCH FOR THIS.

How the heck did i not know this existed?!

A huge thank you to the creator(s) and editor(s) of this document!”

u/LordGuardial

“This is awesome!

I started with dripinvesting.org when I first started really focusing on dividends.

Thank you for sharing.”

u/pinetree64